Think Your Estate Plan is All About Taxes? Think Again.

July 19, 2022

Many people equate estate planning with tax avoidance. They are wrong.

Tax planning is an important part of estate planning. This is especially true when you live in the Northeast, where the threshold for triggering estate tax on the state level is among the lowest in the nation ($1,000,000 in Massachusetts and $1,648,611 in Rhode Island). And your taxable estate includes almost everything you own at death (including your retirement accounts and your home)[i].

However, estate planning is about much more than avoiding taxes. The primary function of your plan is to ensure that your wishes for your assets are carried out when you can no longer do it yourself.

No matter how much money you have or how “simple” your estate or your tax situation, everyone should have accurate and up-to-date versions of these 5 estate planning documents:

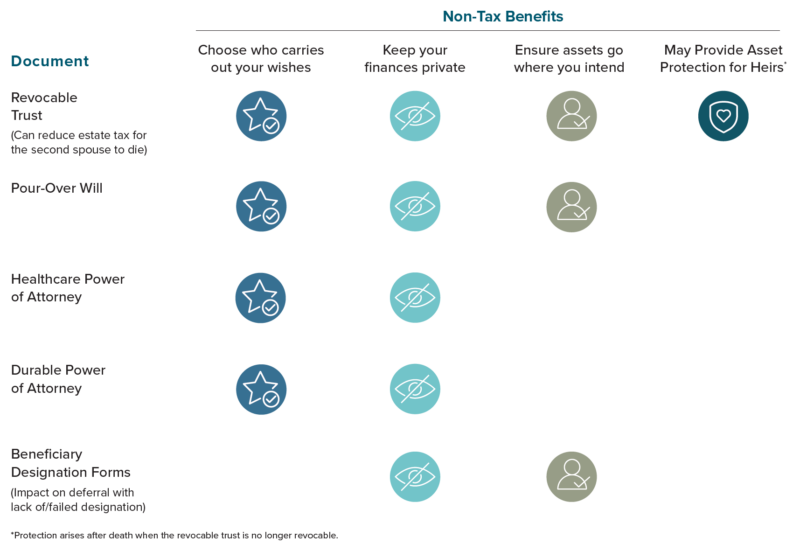

Most of these documents have zero or minimal tax impact, but each document offers non-tax benefits, which may be especially important to you. For example, you:

- Choose who carries out your wishes. A revocable trust, pour-over will, healthcare power of attorney, and durable power of attorney allow you to choose someone to carry out your wishes and your own personal representative after death or in the event of incapacity (e.g. accident, illness, Alzheimer’s, or dementia).

- Keep your finances private. Each of the documents listed enable your heirs to avoid the publicity, inefficiency, and cost of probate or a court proceeding.

- Ensure assets go where you intend. With a revocable trust, pour-over will, and beneficiary designation forms, your estate avoids statutory and contractual default rules (which could have your assets going to a relative you have never met – or wish you hadn’t – or to someone you no longer want to benefit, like an ex-spouse listed on an old beneficiary designation).

- Provide asset protection. After your passing, a revocable trust can ensure your heirs won’t lose their inheritance to third parties as a result of debt, money owed to creditors, a lawsuit, substance use disorder, or divorce to an ex-spouse. We can help you determine whether your trust provides future creditor protection.

Many people don’t want to think about estate planning. However, keeping your plan current gives you the peace of mind that you’ll leave the legacy you envision for your loved ones.

At Washington Trust Wealth Management, we review these documents on a regular basis as part of the financial planning process. If you want to make sure your paperwork is accurate, reach out to your wealth advisor to schedule a review – and take control of your legacy.

Be sure to read the companion article, Summer 2022 Economic and Financial Market Outlook.

[1] Block, S. (2022, February 23). 18 States With Scary Death Taxes. Kiplinger. Retrieved July 19, 2022, from https://www.kiplinger.com/reti...

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.