Summer 2022 Economic and Financial Market Outlook

July 19, 2022

The first half of 2022 has been challenging, to say the least, for the financial markets. U.S. stocks, as measured by the S&P 500, fell 20.6% (excluding dividends), marking the worst first half of a year since 1970. Not to be outdone, the U.S. fixed income market had its worst first half start in history, dropping 10.4%, as measured by the Bloomberg U.S. Aggregate Index.1

High inflation, hawkish central bank activity, rising interest rates, and the portend of an economic slowdown are roiling the markets, forcing a general re-valuation of financial assets.

Signs of a Slowing Economy

The consensus estimate for U.S. GDP growth in 2022 is now 2.5%, down substantially from 4.0% at the beginning of the year.2 Signs of an impending slowdown are becoming apparent, as price spikes across the board test consumer confidence and alter buying behavior.

- Consumer spending patterns are starting to shift. U.S. retail sales in May fell 0.3% from April, the first monthly decline of the year. With gas prices at historic highs of over $5.00 per gallon3 and grocery prices up nearly 12% year over year4, consumers cut back on big ticket and other discretionary spending to fund gas and food purchases.5

- Consumer confidence is waning. The Conference Board’s U.S. Consumer Confidence Index is at its lowest level since Feb 2021.6 And the future does not look bright. The expectations’ component of the index (based on consumers’ forward six-month view of income, business, and labor market conditions) is at its lowest level in almost a decade, suggesting slower economic growth in the months to come.7

- Activity in the housing market is also slowing, with the 30-year fixed rate mortgage rising to 5.83% versus 3.27% at the close of last year.8 Mortgage applications for home purchases have plummeted some 10% year-to-date and are off about 30% from peak levels over the past two years.9

No help from the Fed

The inflation rate hit 9.1% in June,10 forcing the Fed to stay aggressive in their quantitative tightening efforts. Fed Funds futures suggest rates will rise to 3.25%-3.50% by the end of the year, up dramatically from 1.5% %-1.75% currently and 0.0%-.25% at the beginning of the year. The Fed’s hawkish stance will surely have a dampening impact on economic growth as we go through the balance of 2022.11

Still Hope for a Soft Landing

We may already be in a recession - generally defined as two consecutive quarters of negative real GDP growth. First quarter real GDP growth was -1.6%.12 Second quarter growth will be officially reported in late July, but the Federal Reserve Bank of Atlanta estimates a rate of -2.1%.13

But even if we fall into recession, there are still reasons to hope for a soft landing.

- Pent up consumer demand remains for goods and services following the pandemic

- The U.S. labor market is relatively robust, with solid employment growth and income gains

- Corporate balance sheets are strong, and the banking system is well capitalized

It is important to keep in mind that this time around, the slowdown in economic growth is more about supply scarcity, inflation, and Fed policy than a lack of demand. And while still an unpleasant experience, such a recessionary scenario seems a bit more benign than the complete shutdown of the global economy in 2020 or the potential collapse of the banking system in the 2008-2009 recession.

The State of the Financial Markets: Cautious at Best

Fixed Income

We expect interest rates will continue to move higher as the Fed further tightens monetary policy to dampen inflation.

Short-term Yields

Yields on two-year U.S. Treasury bonds ended the second quarter at 2.93%,14 up substantially from 0.73% at the beginning of the year. While short-term yields are at decade highs and much more attractive than even six months ago, it may still be early to dismiss further increases. In fact, as we go through 2022, we expect two-year yields to move towards the expected cycle peak in the Fed funds rate, which the Fed Funds futures market suggests could be 3.25%-3.50%.15

Upcoming reports on inflation will have a significant impact on fed funds rate expectations, and in turn, two-year yields. Higher than expected inflation reports would indicate the Fed will need to stay aggressive and may move fed funds expectations and yields higher; and vice-versa. In any event, yield volatility is likely to stay elevated until we get some clear indication that inflation is under control.

Long-Term Yields

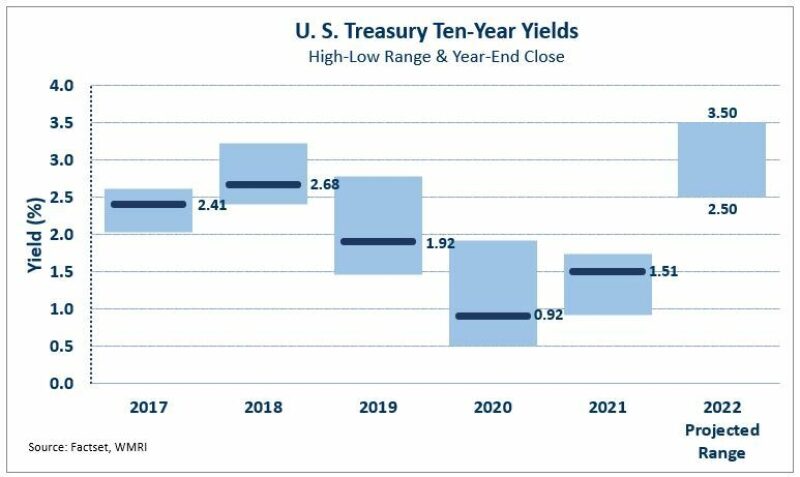

Yields on ten-year U.S. Treasury bonds ended the quarter at 2.98%,16 up from 1.51% at the beginning of the year. We expect longer-term yields to continue to move higher in 2022, driven by both inflation and the Fed’s efforts to reduce the size of its balance sheet (quantitative tightening).

Credit spreads, the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality, have widened but may still not fully reflect an economic slowdown. Both Investment Grade and High Yield Corporate spreads at 1.55% and 5.69% respectively, have widened significantly this year and are close to their twenty-year averages.17 However, credit spreads typically spike well above their long-term averages during economic slowdowns, reflecting heightened credit risks. Further, the end of the Fed’s bond buying program could negatively impact spread pricing in the mortgage and asset-backed segment of the bond market.

We continue then to prefer shorter duration, high quality fixed income exposure to protect from an increase in interest rates and a widening of credit spreads.

Equities

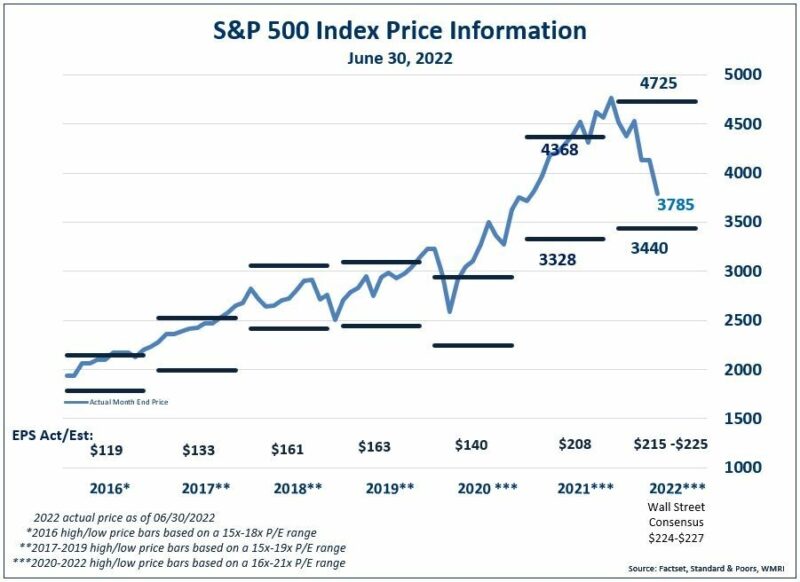

Despite the S&P 500’s 20.6% (excluding dividends) decline year-to-date, we believe additional downside is possible. If the economy falls into recession, even a mild one, a double-digit percentage decline in earnings would surely be possible. Profitability may also be dampened by potential legislation in Washington D.C. that may include increases in corporate taxes.

The recent market declines have resulted in a more reasonable price/earnings ratio of 17.2x versus the 21.7x at the start of the year. However, additional valuation compression is possible. Historically, a higher rate of inflation results in a lower stock market price/earnings ratio.

In addition, a slowing economy and reductions to S&P earnings estimates may negatively impact investor sentiment and put further downward pressure on valuation.

High inflation and interest rates reduce the present value of future earnings, disproportionately impacting the value of growth stocks. Especially in the current environment, then, our preference is to be long-term equity investors with a bias towards high quality companies with strong fundamentals, long-term secular growth potential, and/or long-term dividend growth potential.

We continue to underweight our exposure to international equities. Although valuations appear lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global scale information and medical technology companies. In addition, the Russian/Ukraine conflict has had a more direct impact on economies in Europe, further elevating the recession risk across the Continent. In the emerging markets, heightened risks also keep us cautious - specifically the Chinese government’s recent regulatory crackdown on large information technology companies.

Overall, we maintain our cautious view on near term stock market performance. We expect a slowdown in earnings growth and see continued risk at the current valuation level. Volatility may also stay elevated, due to uncertainty around Fed actions, the war in Ukraine, results of the upcoming mid-term elections, and the potential for new, more virulent COVID strains.

Be sure to check out our companion article, Think Your Estate Plan is All About Taxes? Think Again.

1 Factset; ‘Markets Post Worst First Half of a Year in Decades,’ Akane Otani, Wall Street Journal, June 30, 2022.

2 Factset; July 1, 2022.

3 GasBuddy.com and U.S. Department of Labor

4 U.S. Bureau of Labor Statistics, Consumer Price Index (Food at home), May 2022

5 U.S. Census Bureau, Retail Sales, May 2022.

6 Factset; The Conference Board, June U.S. Consumer Confidence press release, June 28, 2022.

7 Federal Reserve Bank of New York, Survey of Consumer Expectations, June 13, 2022.

8 Bankrate

9 Mortgage Bankers Association – data as of June 24, 2022.

10 Bureau of Labor Statistics, June Consumer Price Index Press Release

11 ‘Fed Raises Rate by .75% Largest Increase Since 1994,’ Wall Street Journal, June 15, 2022.

12 Bureau of Economic Analysis, U.S. GDP first quarter 2022 news release, June 29, 2022.

13 Federal Reserve Bank of Atlanta, GDPNew Model Estimate for 2Q:22, Real GDP Growth, July 1, 2022.

14 Factset

15 CME Group, Fed Watch Tool, July 5, 2022.

16 Factset

17 Factset

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.