Q4 Economic and Financial Market Outlook

October 17, 2023

By: Peter R. Phillips, CFA®, CAIA®

Senior Vice President and Chief Investment Officer

Washington Trust Wealth Management

With the economy and markets performing far better than expected through the first three quarters of 2023, optimism and upgrades to outlooks prevail... but there are still reasons to remain cautious.

Q3 and YTD Recap: Performing Above Expectations

The U.S. economy continues to perform above expectations. First and second quarter U.S. GDP growth of approximately 2.1% was much better than the slightly negative growth rate expected as we entered 2023[i]. Consumer spending remained strong, driven by a strong labor market. Positive economic momentum carried into and through the third quarter, as suggested by the Atlanta Fed’s GDPNow estimate of 4.9%[ii].

Stronger than expected economic growth and the still robust labor market is keeping the Fed hawkish (restrictive). The Fed raised the Fed funds rate 25bp during the quarter, with a 25bp increase at the July meeting and no change at the September meeting.[iii] Federal Open Market Committee (FOMC) members project an additional increase in 2023 and expect rates to remain elevated through 2024[iv].

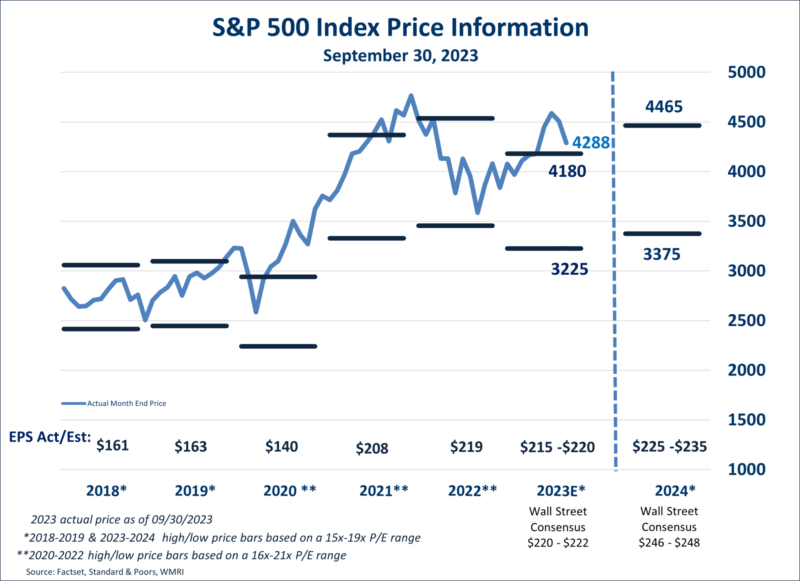

As a result, market interest rates/yields rose sharply in the third quarter, negatively impacting both fixed income and equity market returns. The 10-Year U.S. Treasury yield rose 76bp to 4.57%, the highest yield in 15 years. The Bloomberg U.S. Aggregate Index was down 3.2% in the quarter, reflecting the sharp increase in market interest rates, and is now down 1.2% YTD. The S&P 500 fell 3.3% in the quarter, breaking a strong rally over the previous three quarters of over 25%. Year-to-date, the S&P remains in positive territory, up 13.1%.[v] The Artificial Intelligence (AI) investment theme remains quite powerful and driving outsized returns for the stocks of companies with exposure to AI, especially the “Magnificent Seven” (Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta (Facebook) and Tesla).

Economic Outlook: Upgraded, but Caution Still Warranted

Better than expected economic growth through the first three quarters of 2023 lead to an upgraded outlook on the economy. The FactSet consensus 2023 U.S. GDP growth estimate is now 2.0%, up significantly from the 0.3% estimate at the beginning of the year.[vi]

The U.S. labor market continues to generate strong new job growth. The pace of monthly employment growth continues to exceed expectations and remains above pre-pandemic levels. Job growth is broad-based across most all industry types. An additional 2.3 million jobs have been created through the first three quarters of 2023 and the unemployment rate of 3.8%, while up from a low of 3.4% earlier in the year, remains near historic low levels[vii].

The strong employment landscape has resulted in good personal income gains. Real (after adjustments for inflation) disposable personal income is improving and grew at a relatively robust 3.7% over the past year.[viii] And good personal income gains have resulted in continued consumer spending. Real personal consumption expenditures are growing at a relatively solid 2.3% year over year pace.[ix]

Looking for a Soft Landing

An economic slowdown is still expected in the quarters ahead; however, the consensus expectation is that the Fed will be able to engineer an economic “soft landing.”[x] The FactSet consensus 2024 U.S. GDP growth estimate is now 0.8%, down from 1.3% at the beginning of the year, but up from 0.6% in August.[xi] Importantly, while growth is expected to slow, it appears that the economy has the potential to avoid negative quarterly growth in 2024. Despite this improved outlook, there are just too many indicators suggesting a cautious outlook is still warranted.

"Despite the improved outlook, there are just too many indicators suggesting a cautious outlook is still warranted."

More Fed Impact

First and foremost is the Fed’s restrictive monetary policy stance. We have seen the largest and fastest rate increase since 1980, with 525bp increases in just 18 months, and another 25bp projected. Further, the median FOMC member projected Fed funds rate for 2024 is now 5.1%, up from a 4.6% projection made only three months prior at the June 2023 meeting. Essentially, this means a forecast for higher rates – and for longer.[xii]

The Fed funds futures market suggests the Fed is finished with rate hikes and will begin cutting rates in June 2024.[xiii] A quicker pivot to a more accommodative monetary policy stance could be a positive for the economic outlook. Nevertheless, the impact of monetary policy involves “long and variable lags” that can take 9 to 24 months to impact the economy.[xiv] Past Fed fund rate increase cycles have led to a slowdown in economic growth and often recession.

Inverted U.S. Treasury Yield Curve

An inverted U.S. Treasury yield curve has also been a reliable indicator of recession. Both the 2y – 10y U.S. Treasury spread and 3m – 10y U.S. Treasury spread were inverted on September 30, 2023 (at -47 bp and -89 bp, respectively) and have been for an extended period. This is a significant improvement from spreads that were well wider than -100bp earlier in the year. However, rather than an indication of improving economic conditions, this flattening may have more to do with technical factors related to the resolution of the U.S. debt ceiling back in June and the resumption of U.S. Treasury security issuance to fund government spending. The Federal Reserve Bank of New York’s recession probability indicator, based on U.S. Treasury yield spreads, puts the probability of recession within the next twelve months at 56%.[xv]

Continued Banking Industry Challenges

Challenging operating conditions in the banking industry remain a concern. Although fallout from bank failures earlier in the year appears to have been contained, and results of the Fed’s recent annual stress test on the country’s largest banks suggests these banks are sufficiently capitalized,[xvi] operating conditions continue to be problematic for the banking industry. Deposit outflows appear to have stabilized, but higher-yielding competing products may continue to draw deposits out of the banking system and increase banks’ funding costs, hurting profitability. Deposit outflows also present potential liquidity challenges.

Additionally, banks continue to hold significant unrealized investment losses in their investment securities portfolios. As of June 30, 2023, this amounted to $558 billion, or roughly 25% of bank equity capital[xvii]. We suspect this did not improve in the third quarter, given that market interest rates have moved sharply higher since June 30 (the price/value of a bond moves inversely with the direction of interest rates). The combination of higher borrowing costs and reduced liquidity could serve to further tighten bank lending standards, which are already at levels historically associated with economic slowdown and recession.[xviii]

U.S. Government’s Fiscal Health

We also continue to be concerned about the U.S. Government’s fiscal condition and its potential to negatively impact government spending and tax policy, and in turn, economic growth. The gross debt of the United States government has grown $10 trillion, or 43%, since the end of 2019 (just before the pandemic) – and now stands at $33.2 trillion (as of 9/29/23),[xix] Due to the significantly higher debt levels and the sharp rise in interest rates over the past year, the Congressional Budget Office (CBO) estimates that net interest payments on the nation’s debt (or the cost to just service the debt) will rise to over 15% of total government revenue by 2025, up from 9.7% in 2022 and an average of 8.7% from 2013-2022. This has significant implications for government spending and tax policy in the years to come, especially given the U.S. budget already operates in a deficit, which the CBO estimates to be approximately 18% of revenue in 2023.[xx]

Further, the recent political upheaval related to passing annual appropriations bills—and the resulting unprecedented removal of the Speaker of the House—illustrates the increasingly dysfunctional political environment in Washington and heightened U.S. fiscal policy risk. Congress has until November 17 to act on budget appropriations or the country faces, once again, the potential of a government shutdown.

Other Economic Indicators

Various other economic indicators also suggest caution is warranted. The Conference Board Leading Economic Index (LEI), which includes ten components across financial, labor, manufacturing, consumer and housing markets, has declined in each of the last seventeen months and has reached a level that signals recession within the next 12 months.[xxi] Although The Institute for Supply Management (ISM) Index of manufacturing activity improved over the past few months, it remains at a level that suggest economic contraction.[xxii] Consumer confidence levels have fallen, especially the future expectations component, which is at levels typically associated with recession.[xxiii]

Geopolitical Risk

Geopolitical risks have re-emerged as a concern, with now two significant military conflicts – Russia/Ukraine and Israel/Hamas - posing risk to the global economy; not to mention their horrific humanitarian impact. While the head of the International Monetary Fund warned that the Israel-Hamas war is a "new cloud" that threatens an already murky global economic outlook, US Treasury Secretary Janet Yellen believes the war is unlikely to have a significant impact. [xxiv] [xxv]

"In general, 2024 GDP growth estimates suggest the economy will slow, but achieve a soft landing - avoiding a deep and protracted recession."

Financial Markets

In general, we maintain our near-term cautious outlook for both the equity and fixed-income markets. Fifteen-year high fixed income yields and more reasonable equity market valuations following poor third quarter price performance are reasons for optimism. However, near-term uncertainty on Fed policy, the banking industry, and the trajectory of the U.S. economy are some of the factors that make it difficult to have high conviction that it will be all smooth sailing for the markets over the coming months and quarters.

Fixed Income

The large increase in yields over the past quarter and year surely make fixed income investments more attractive and it is probably a time to add some duration to portfolios, with a continued preference for high quality.

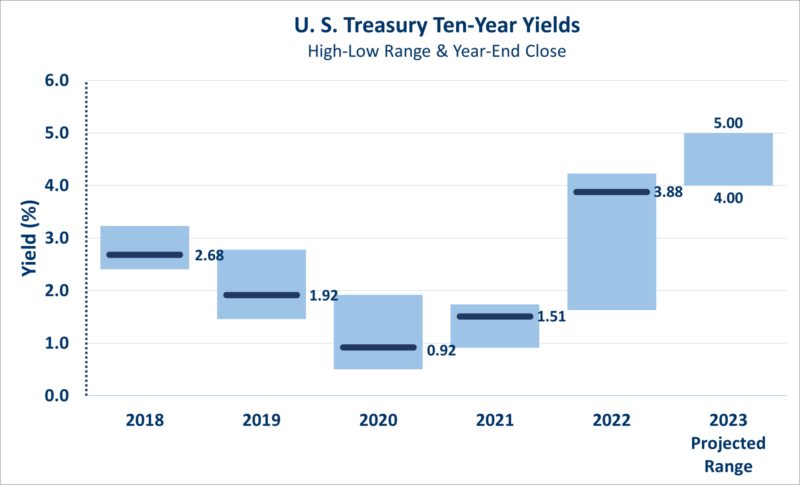

Portfolio Duration. The 2-year Treasury ended the quarter yielding 5.04%, up sharply from 4.42% at the beginning of the year and close to the 15+ year high of 5.17% achieved in late September. The 10-year Treasury ended the quarter yielding 4.57%, up from 3.88% at the beginning of the year; and just below the fifteen-year high.[xxvi]

Yields could continue to trend upward, given still higher-than-target inflation levels and expectations for an additional Fed funds rate increase. Conversely, an economic slowdown and/or recession would likely reduce Fed fund rate expectations and also create a “flight to quality,” both of which would likely result in lower bond yields and positive returns for fixed income investments.

Trying to time the exact inflection point of peak yields is probably not the best investment strategy. With yields near 15-year highs and still elevated recession risk, it likely makes sense to add some duration to portfolios and lock in some higher yields for the longer term.

Credit Spreads. Given the still high probability of recession and likely widening credit spreads, it may be too early to add exposure to lower-quality corporate bonds and other higher-risk, credit-sensitive segments of the fixed-income market. Investment grade spreads at 121bp remain slightly below the twenty-year average of about 149 bp and significantly below spreads during economic slowdowns and recessions. High Yield spreads at 412bp remain significantly below the 20-year average of about 494bp, and significantly below spreads during economic slowdowns and recessions.

U.S. Equity

The third-quarter pull-back in stock prices and stabilization in corporate earnings estimates surely creates a more constructive outlook for the U.S. equity market; however, expectations for a slowing economy keeps us cautious.

Corporate Earnings. Consensus 2023 and 2024 S&P 500 earnings per share (EPS) estimates have been consistently moving lower over the past year; however, a better-than-expected economy so far in 2023 has resulted in some stabilization. Nevertheless, the consensus expectation is for S&P 500 earnings to grow a very modest 1% in 2023 and accelerate to 12% growth in 2024[xxvii]. 2024 earnings growth of 12% appears a bit aggressive given 2024 GDP growth expectations of only 0.8%. Economic slowdowns and recessions typically result in EPS declines. The median EPS decline during recession is 22%. [xxviii]

Valuation. The third quarter pull back in stock prices puts the current S&P 500 price/earnings ratio (valuation) based on 2024 estimates at 17.3x. While down from the over 20.0x valuation earlier in the year, this is not a cheap valuation, especially in a high inflationary and interest rate environment. If inflation fails to continue to move lower, then we see a downside risk to valuation. There is an inverse correlation between inflation and p/e ratios; higher inflationary environments typically result in lower p/e ratios. We still view the current valuation level leaving little room for any disappointment, whether it be from the economy, corporate earnings, or some other unforeseen risk.

Artificial Intelligence (AI) Investment Theme. To be sure, a small subset of mostly information technology stocks with exciting growth potential related to artificial intelligence (AI) technologies account for an extremely large portion of the S&P 500’s performance year-to-date. The ‘Magnificent Seven’, as they have become known, have an average year-to-date price return of 88% and account for over 90% of the S&P 500’s year-to-date price return.[xxix] Excluding the ‘Magnificent Seven’, the average stock in the S&P 500 has a return of 1.2%. We share the enthusiasm for the potential of AI to transform our lives and businesses across many industries; however, recent stock price strength may be a bit premature.

International Equity

We continue to underweight our exposure to international equities but recognize that international equity performance can benefit from a weaker U.S. dollar, which is the consensus forecast for the coming quarters.

Although valuations appear significantly lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global-scale information and medical technology companies. In addition, the Russian/Ukraine conflict has a much greater and direct impact on economies across Europe. Recession risk is elevated across Europe. In the emerging markets, heightened risks keep us cautious—specifically, geopolitical risks related to China and the Israel/Hamas war.

We would expect a weaker U.S. dollar to boost unhedged international investment returns. Although the U.S. dollar has strengthened considerably since mid-July, the consensus forecast calls for further dollar weakness in anticipation of lower U.S. inflation, a more neutral-to-accommodative U.S. Federal Reserve policy, and improving global economic growth relative to the U.S. As such, we do see value in having some exposure to international equities.

Long Term Perspective

While our near-term outlook remains one of caution, it is important to remain focused on a long-term financial plan and investment strategy. If you have questions about how the market and economy are impacting your portfolio, your Washington Trust team is here to help.

[i] FactSet

[ii] Federal Reserve Bank of Atlanta, 2q:23 GDPNow estimate, October 5, 2023

[iii] Federal Reserve FOMC press releases July 26, 2023 and September 20, 2023

[iv] Federal Reserve, FOMC Summary of Economic Projections, September 20, 2023

[v] Market return data from FactSet.

[vi] FactSet

[vii] FactSet

[viii] FactSet

[ix] FactSet

[x] An economic ‘soft landing’ is an economic slowdown that avoids recession.

[xi] FactSet

[xii] Federal Reserve, FOMC Summary of Economic Projections, September 20, 2023

[xiii] CME FedWatch Tool, November 10, 2023

[xiv] Federal Reserve Bank of St. Louis, “Examining Long and Variable Lags in Monetary Policy’, Bill Dupor, May 24, 2023.

[xv] FactSet, Federal Reserve Bank of New York

[xvi] Board of Governors of the Federal Reserve System, 2023 Federal Stress Test Results, June 2023

[xvii] FDIC Quarterly Banking Profile, Second Quarter 2023

[xviii] FactSet, Federal Reserve, July 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

[xix] U.S Department of the Treasury. Fiscaldata.treasury.gov

[xx] Congressional Budget Office. An Update to the Budget Outlook: 2023 to 2033, May 2023

[xxi] The Conference Board, US Leading Indicators press release, June 22, 2023

[xxii] FactSet

[xxiii] FactSet

[xxiv] Reuters: Israel-Hamas conflict is 'new cloud' darkening economic outlook - IMF chief

[xxv] CNN: Janet Yellen sees limited economic impact from war in Israel

[xxvi] All U.S. treasury yield information from FactSet

[xxvii] FactSet. FactSet Earnings Insight – 9/29/23

[xxviii] Strategas

[xxix] FactSet, Washington Trust calculations

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.