Q2 Economic and Financial Market Outlook

April 20, 2023

By: Peter R. Phillips, CFA®, CAIA®,

Senior Vice President and Chief Investment Officer,

Washington Trust Wealth Management

With the news full of bank failures, inflation, and the largest and fastest Fed rate cycle since the 1980s, what can you expect for the rest of 2023?

Q1 Recap: Financial Markets Rally

Financial markets continued to recover from late 2022 lows, despite a still hawkish Fed and two of the largest bank failures in U.S. history[i]. Looking at equity markets, the S&P 500 produced a total return of 7.5% in the first quarter of 2023, on top of a 7.6% return in the fourth quarter of 2022 and has returned 15.8% from lows reached in October 2022.[ii] The Nasdaq Composite Index, which is heavily exposed to faster growth technology companies, produced a total return of 17.0% in the quarter and 20.0% from lows reach in late 2022.[iii] Shifting to fixed income markets, the Bloomberg US Aggregate Index returned 3.0% in the quarter and is up 7.7% from lows in October 2022.[iv]

Bank Industry Woes

The recent failures of Silicon Valley Bank (SIVB) and Signature Bank (SBNY), the second and third largest bank failures in U.S. history[v], have so far been contained. Swift action by the Fed, Treasury Department, and the FDIC seems to have limited a broader bank run. In addition, the infusion of $30 billion of deposits into struggling First Republic Bank (FRC) from a group of the country’s largest banks (including JP Morgan, Citigroup, Bank of America, and Wells Fargo), helped demonstrate the overall resilience of the banking system and limit a broader panic.[vi]

Future challenges. While broader panic has so far been averted, operating conditions for the banking industry are likely to be challenging going forward.

Deposits. Commercial banks lost approximately $500 billion in deposits in the month of March[vii]. Most of this was low-cost deposits that will need to be replaced, but at significantly higher borrowing costs for the banks. And regardless of consumers’ viewpoints on bank deposit safety, there is likely to be a continual outflow of deposits as consumers seek higher interest rates on their savings from competing products such as money market funds.

Investment Securities. Banks are also holding significant unrealized losses in their investment securities portfolios due to the sharp rise in interest rates over the past year. At year-end 2022 this amounted to $620 billion[viii], which is likely to be lower, although still significant, when March 31 data is reported, given the sharp decline in interest rates so far year to date. Importantly, bank securities portfolios are typically invested in very high-quality fixed income securities and the face value of these securities will likely be received at maturity. In the interim, however, substantial losses would be realized if banks needed to liquidate these investments to fund deposit outflows. As such, banks’ near-term liquidity is negatively impacted by this situation.

Regulations. We also would not be surprised to see additional accounting and regulatory requirements on the banking industry, including changes to the accounting for unrealized losses, capital and liquidity requirements, and FDIC insurance levels.

Lending.

The combination of higher borrowing costs, reduced liquidity, and potentially more regulation for the banking industry could result in tighter credit conditions for households and businesses; this, in turn, could slow the economy. Even before the collapses of SVB and SBNY, Fed surveys of bank lending indicated that lending standards were tightening and the cost of borrowing increasing.[ix]

"The combination of higher borrowing costs, reduced liquidity, and potentially more regulation for the banking industry could result in tighter credit conditions for households and businesses, and in turn, slow the economy.”

Markets: Bad News is Good News

The bad news related to bank failures has so far translated to good news for the markets. Investors appear to be betting that banking industry woes will force the Fed to pause rate hikes and begin cutting rates by late summer. Lower rates would then help the economy maintain economic momentum and avoid recession, or so the positive equity market reaction seems to suggest. However, a Fed pivot to lower rates likely means the economy is faltering. While this may provide a boost to bond prices and returns, it would likely mean a still uncertain and rocky road for equity prices. History suggests that equity prices fall following the first Fed rate cut, and on average don’t reach a low point until months after.[x]

2023 Outlook: Economic Slowdown

We continue to expect the economy to slow in 2023, due to multiple indicators.

More Fed Impact

The largest and fastest Fed rate cycle since the 1980s[xi], resulting in interest rates going up from 0% to 5% in a year, is likely enough to generate a slowdown. And the Fed may not be finished with increases; although recent bank industry concerns may mean we are close to the end. At the March 22, 2023, Federal Open Market Committee (FOMC) meeting, Fed Chair Jerome Powell reiterated the FOMC’s focus on fighting inflation despite recent bank industry concerns. However, he did acknowledge that recent events will likely result in tighter credit conditions, which could serve as the equivalent of Fed rate increases.

Nevertheless, the FOMC anticipates that “some additional policy firming will be appropriate.” Fed funds futures market suggest one more 25bp increases in May, with a terminal value of 5.00% - 5.25%, followed by the start of rate cuts in July[xii]. Historically, Fed fund rate increase cycles result in slower economic growth and, in most cases, recession.

Bank Industry Challenges

Regardless of the Fed’s actions going forward, Fed actions to date along with bank industry challenges are likely enough to slow the economy. The percentage of senior loan officers reporting a tightening of lending standards is also at a level associated with economic slowdown and recession.

Economic Indicators Weakening

We are already seeing a slowdown in certain areas of the economy. Existing home sales have fallen to levels not seen since the Great Financial Crisis (2008-09). Auto sales have not recovered from the pandemic-induced supply constraints. The Institute for Supply Management (ISM) Index of manufacturing activity has been weakening since 2022 and suggesting economic contraction, with the new orders and backlog components of the index especially concerning[xiii]. Consumer confidence levels have fallen, especially the future expectations component, which is at levels typically associated with recession.

Stubborn Inflation

Inflation remains at an extraordinarily high level and continues to be a burden on household and business finances. The Consumer Price Index (CPI) as of March 2023 rose 5.0% year-over-year, down from its peak of 9.0% (core of 5.6%, down from peak of 6.7%); and the Personal Consumption Expenditures (PCE) Price Index as of February 2023 rose 5.0% year-over-year, down from a peak of 7.0% (core of 4.6%, down from a 5.4% peak). Nevertheless, all measures remain significantly above the Fed’s long-term target of about 2.0%. Food and shelter price increases, which make up approximately half of the CPI Index, remain stubbornly high[xiv].

Food at home (grocery) prices, while moderating somewhat, are up 8.3% year-over-year[xv]. Energy prices were falling; however, OPEC recently announced supply cuts, which could limit additional easing of oil prices. Crude oil prices of about $80 per barrel are down significantly from the $100-$120 during 2022; however, excluding last year’s price spike, $80 per barrel would still be an 8-year high for oil prices[xvi].

High food and energy prices continue to present a significant budget challenge for many households.

“Inflation remains at an extraordinarily high level and continues to be a burden on household and business finances. High food and energy prices present a significant budget challenge for many households.”

Traditional Indicators Suggest Recession Risk is High

Recession is not inevitable, but the risk is certainly elevated. Historically, Fed tightening cycles have typically been followed by recession. An inverted U.S. Treasury yield curve has also been a very good indicator of recession. Both the 2y – 10y U.S. Treasury spread and 3m – 10y U.S. Treasury spread were decidedly inverted on March 31, 2022, at -57 bp and -126 bp, respectively – and have been for an extended period[xvii].

“From our viewpoint, there are too many indicators pointing to economic slowdown and/or recession to ignore.”

Anemic U.S. GDP Growth Estimate

We expect U.S. GDP growth in 2023 to slow significantly from the roughly 2.1% growth rate in 2022. The Factset consensus 2023 U.S. GDP estimate is 0.9%, which is actually up from 0.3% at the beginning of the year due to stronger than expected activity in the first few months of 2023[xviii]. Nevertheless, consensus expectations suggest flat to negative growth over the balance of 2023. This seems to be a reasonable forecast, although one with significant uncertainty. We will certainly follow conditions closely and alter our views as appropriate.

Reasons for Hope

Nevertheless, even if we fall into recession there are still some reasons to hold out hope for avoiding a deep recession. Optimists point to the strong labor market as reason the U.S. economy will avoid recession. The U.S. economy continues to create a respectable number of jobs – averaging 344,000 per month over the past three months – and the unemployment rate at 3.5% continues to hover near all-time lows[xix]. In 2022, 4.8 million jobs were gained on top of 7.3 million in 2021. Employment is now about 3.2 million jobs above the pre-pandemic level[xx].

Further, job openings of about 9.9 million are 1.67x larger than the number unemployed at 5.9 million[xxi]. Despite several high-profile layoff announcements in the information technology sector, the labor market is very tight, and it is difficult to fill open positions. Some postulate that this condition may keep employers from laying off workers even if weaker economic conditions emerge, thereby keeping the economy from falling into deep recession.

Financial Markets

In general, we maintain our near-term cautious outlook for both the equity and fixed income markets but see an opportunity to get more constructive as we go through 2023. Near-term uncertainty on Fed policy, the banking industry, and the trajectory of the U.S. economy will likely keep financial markets somewhat volatile.

Fixed Income

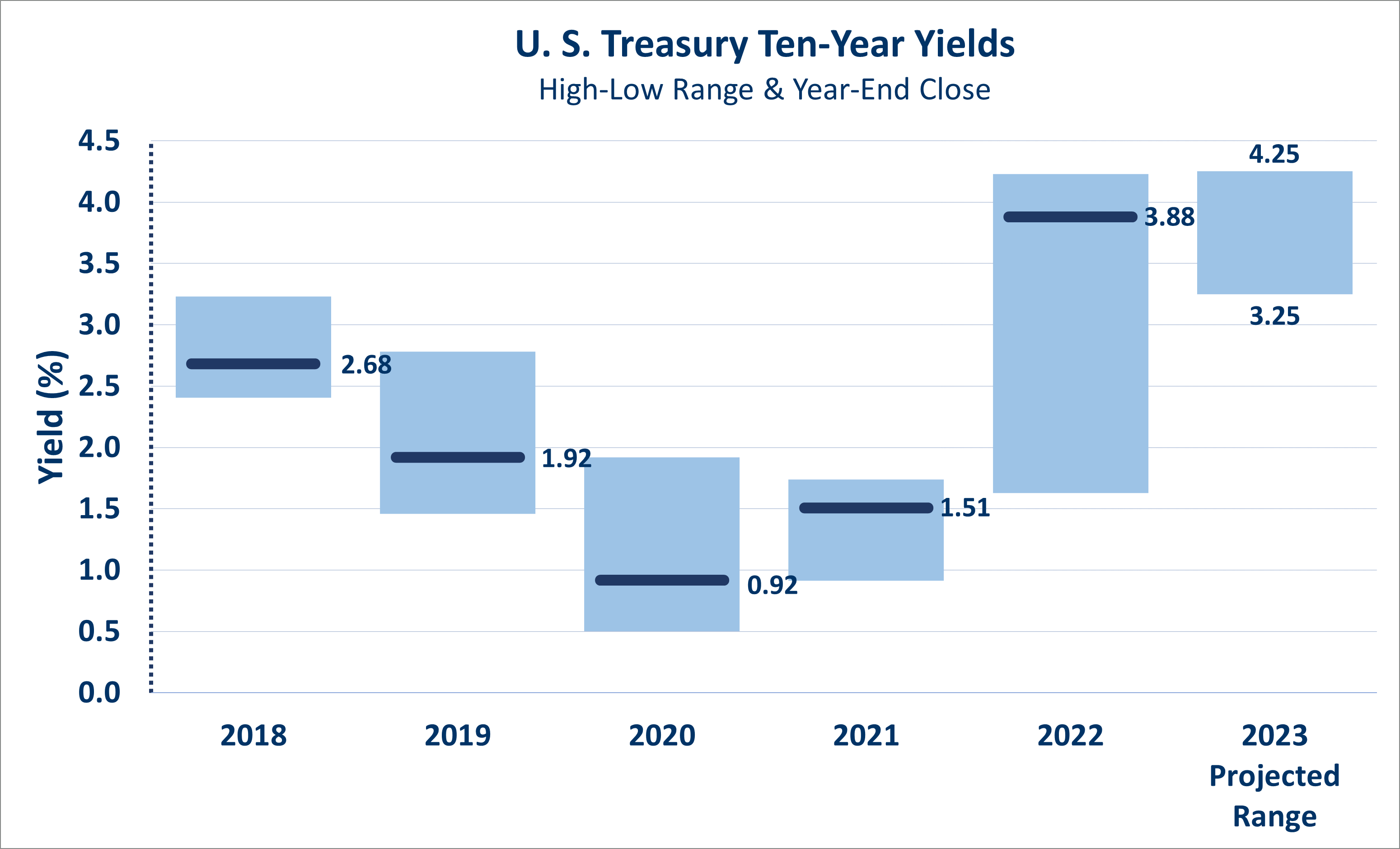

We continue to have a cautious view of the fixed income market and maintain a preference for low duration and high quality. However, with yields near 15-year highs and elevated recession risk, it may make sense to add duration to portfolios. Given the high probability of recession and likely widening credit spreads, it may be too early to add exposure to lower quality corporate bonds and other higher risk, credit sensitive segments of the fixed income market.

Portfolio Duration. The large increase in yields over the past year has made fixed income investments more attractive, and it is probably time to add some duration to portfolios. The 2-year Treasury ended the quarter yielding 4.06%, down considerably from 5.06% in early March, but up from a low range of 0.10%-0.20% during early 2021 and still among the highest yields in about 15 years. The 10-year Treasury ended the quarter yielding 3.49%, down considerably from 4.08% in early March, but up from a low of 0.51% in August 2020 and still among the highest yields in about 12 years[xxii].

With market expectations for a Fed pause in May, a slowing economy, and rate cuts starting in July, it may be that yields have seen their peak for this cycle. Although yields could make another move higher, especially with inflation at still stubbornly high levels, an economic slowdown and/recession would likely reduce Fed funds rate expectations and create a “flight to quality,” both of which would likely result in lower bond yields and positive returns for fixed income investments.

Credit Spreads. Credit spreads do not appear to price in a slow economy and/or recession; therefore, it may be too early to add exposure to lower quality corporate bonds. Investment grade spreads at 140bp remain slightly below the 20-year average of about 149 bp and significantly below spreads during economic slowdowns and recessions. High Yield spreads at 465bp remain slightly below the 20-year average of about 496bp, and significantly below spreads during economic slowdowns and recessions[xxiii].

U.S. Equity

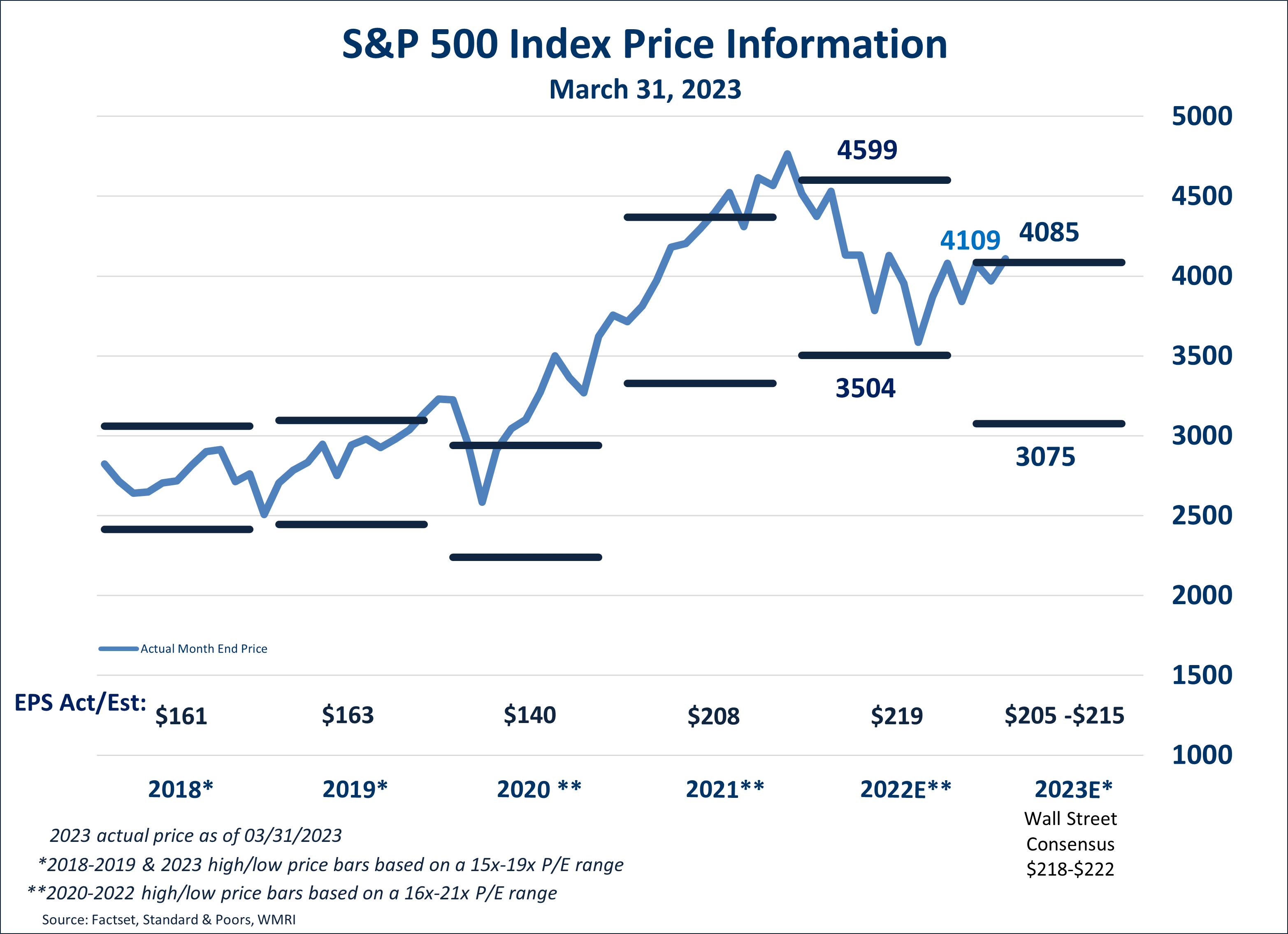

We continue to have a cautious outlook for stock prices. With the recent stock price rally, stocks do not appear “cheap,” and we expect earnings estimates to fall, which could lead to downward pressure on stock prices. Corporate earnings estimates are too high and not consistent with economist’s consensus forecast for an economic slowdown and/or recession. Current consensus S&P 500 earnings call for 2023 earnings growth of 1.0% following a 5.1% growth rate in 2022; however, economic slowdowns and recessions typically result in EPS declines. The median EPS decline during recession is 22%.[xxiv]

Although the S&P 500’s price/earnings ratio (valuation) compressed significantly in 2022, the rally in stock prices so far this year puts the current S&P 500 p/e ratio based on 2023 consensus estimates at 18.6x. This is not necessarily a cheap valuation, especially in a high inflationary and interest rate environment. There is an inverse correlation between inflation and p/e ratios. Higher inflationary environments typically result in lower p/e ratios. If inflation fails to subside in the coming year, then we see a downside risk to valuation.

Additionally, we expect stock price volatility to remain elevated as investors looking for “pivot” points evaluate earnings results, economic data, and “Fed speak,” which will undoubtedly provide fodder for both bulls and bears – and bull and bear tug of wars.

International Equity

We continue to underweight our exposure to international equities. Although valuations appear lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global scale information and medical technology companies. In addition, the Russian/Ukraine conflict has a much greater and direct impact on economies across Europe. Recession risk is elevated across Europe. In the emerging markets, heightened risks keep us cautious – specifically, geopolitical risks related to China.

A Word of Reassurance

It is important to keep in mind that economic slowdowns and recessions are an inevitable part of our economic cycles, and we seem to find our way through – even those recessions caused by the most ominous of circumstances. While it’s tempting to change your investing strategy when things aren’t going well, the worst mistake investors make in volatile or down markets is losing sight of their long-term financial strategy. Staying the course with a sound, long-term financial plan—investing in the market for the financial marathon, not a sprint—will help you ride out downswings, potentially preserve your assets, and capitalize on upswings.

In over 200 years of wealth management at Washington Trust, there is one thing we know for certain: Eventually, the market will recover.

If you’re concerned or have questions about how the market and economy are impacting your portfolio, your Washington Trust team is here to help.

[i] Barron’s, ‘Largest Bank Failures Since 2008’, March 14, 2023.

[ii] Factset. The S&P 500 Index is a stock market index tracking the stock performance of 500 leading companies in leading industries across the U.S. economy.

[iii] Factset. The Nasdaq Composite Index is a broad-based stock index that includes over 2,500 companies listed on the NASDAQ Stock Market.

[iv] Factset. The Bloomberg U.S. Aggregated Index is a broad-based index tracking the performance of the U.S. investment grade fixed-rate taxable bond market.

[v] Barron’s, ‘Largest US Bank Failures Since 2008’, March 14, 2023

[vi] Wall Street Journal, ’Eleven Banks Deposit $30 Billion in Fist Republic Bank’, March 16, 2023

[vii] Federal Reserve, Assets and Liabilities of Commercial Banks in the US – H.8, April 7, 2023

[viii] FDIC Quarterly, December 31, 2022, Volume 17, Number 1

[ix] Federal Reserve, January 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices, February 6, 2023.

[x] Strategas. “Trading days from first Fed rate cut to S&P market low vs. S&P 500 % change from first Fed cut to market low.”

[xi] Factset

[xii] CME FedWatch Tool, April 10, 2023

[xiii] Factset

[xiv] Factset

[xv] Factset

[xvi] Factset

[xvii] Factset

[xviii] Factset

[xix] All jobs related data from Factset

[xx] Factset

[xxi] Factset

[xxii] Yield data from Factset

[xxiii] Credit spread data from Factset

[xxiv] Strategas

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.