Q2 Economic and Financial Market Outlook

April 22, 2024

By Peter R. Phillips, CFA®, CAIA®

Senior Vice President and Chief Investment Officer

Washington Trust Wealth Management

Q1 Recap: Riding High

The positive economic momentum from 2023 has continued into 2024, with the U.S. economy continuing to outpace expectations, supporting stock market gains. However, the stronger economy has meant higher interest rates and a headwind for fixed income returns. The Atlanta Fed GDPNow Forecast is for 2.9% real GDP growth in the first quarter of 2024,i driven by a still strong job market and personal spending increases. The full year FactSet 2024 U.S. GDP growth consensus forecast has increased from 1.2% to 2.1%.ii

Equity markets continue to move higher. The S&P 500 produced a 10.6% total return in Q1.iii The strong economic performance in Q1 buoyed expectations that the U.S. economy will not experience a substantial slowdown in 2024, providing support for the 2024 corporate earnings outlook. While Fed rate cuts expectations have been tempered, investors still expect the Fed to begin lowering rates in 2024, helping both economic momentum and providing support for equity market valuations.

Fixed-income markets returns were slightly negative, with the Bloomberg U.S. Aggregate Bond Index returning -0.8% in the first quarter.iv The stronger than expected economy in Q1 and higher than expected inflation readings have moderated Fed rate cut expectations, sending interest rates higher. High-yield bonds outperformed as spreads tightened, reflecting the improving economic outlook.

The consensus economic outlook has gone from recession to soft landing to no landing in the span of a year.

From Hard Landing to No Landing

The consensus economic outlook has gone from hard landing (recession) to soft landing (moderate slowdown) to no landing (continued growth) in the span of a year.

In mid-year 2023, the FactSet consensus 2024 U.S. GDP growth estimate was 0.6%, with a high perceived probability of recession. As we entered 2024, the FactSet consensus 2024 U.S. GDP growth estimate increased to 1.2%, with an expectation of a soft landing.v Now in April 2024, the FactSet consensus 2024 U.S. GDP growth estimate has risen to 2.1%. While a slower pace than the 2.5% growth rate experienced in 2023, this is still a relatively respectable rate of expansion for the economy.

Job Creation Continues

Labor demand and consumer spending continue to be robust, defying headwinds and forecasts. The U.S. economy has generated positive job growth for 46 out of the past 47 months (since the massive 2020 layoffs resulting from the COVID-induced global economic shutdown). Since May 2020, 27.7 million jobs have been added, well above the 21.9 million lost during the height of the pandemic. The unemployment rate of 3.8%, while up from a low of 3.4% in early 2023, continues to remain at a historically low level.

And despite this seemingly “full” employment condition, several high-profile layoff announcements, and forecasts for slower employment trends, the economy continues to generate impressive job growth, averaging 276,000 new jobs per month through the first three months of 2024. For context, for the ten years prior to the COVID shutdown, the monthly average job gain was 188,000.

The outlook for additional gains in employment appears positive. Job openings of 8.8 million, while down from a high of 12.2 million two years ago, is well above the estimated 6.4 million unemployed workers looking for jobs in the U.S.vi

Personal Income Gains and Consumer Spending

A strong labor market supports personal income gains and consumer spending. Personal income is growing at respectable 4.6% annual rate (year over year as of February 2024) and despite still high inflation levels, real hourly earnings and real disposable personal income (both adjusted for inflation) are still positive at 1.1% and 1.7% (year over year as of February), respectivelyvii viii. To be sure, income growth rates are decelerating, but the still tight labor market is expected to keep income gains positive.

Personal consumption expenditures—typically the largest component of GDP growth—are growing at a 4.9% annual rate (year over year as of February 2024) and on a real basis (adjusted for inflation) are growing at a 2.4% rateix. While spending on durable goods has weakened a bit (mostly in auto related categories), spending on services remains quite strong, including restaurants and travel. Consumer sentiment related to the job market and their present situation remains near post-pandemic high levels, helping to support continued spending gains.x

Key Economic Indicators: Signs of Improvement

Key economic indicators are showing signs of improvement, suggesting that some lagging areas of the economy may have troughed and may be on the upswing. The Leading Economic Index (LEI)—which includes ten components across financial, labor, manufacturing, consumer, and housing markets—increased in February for the first time in two years, led by improvements in the manufacturing areas of the economy, residential housing, and stock market pricesxi. The Institute for Supply Management (ISM) index of manufacturing activity indicated expansion in the manufacturing sector of the economy in its March 2024 reading, the first positive reading since October 2022. Importantly: the new orders component of the index was suggesting growth in new orders—only the second time since August 2022xii.

The U.S. housing market may be stabilizing. Existing home sales (by far the largest part of the market) that had fallen to Global Financial Crisisxiii levels in 2023 following a sharp rise in mortgage rates, are up 8.8% from trough levels in October 2023xiv. Housing starts (new construction) have been relatively strong and stable throughout the pandemic and home price gains, also strong throughout the pandemic, were up 6.6% on a year over year basis in Januaryxv.

Government Spending

Government spending has also been supportive to the economy—and is likely to continue. The U.S. government continues to run a significant budget deficit. In 2023, that amounted to $1.7 trillion dollars, or 6.3% of GDP. Since the pandemic (2020), the cumulative deficit is a staggering $9 trillion. Expectations are for the U.S. to continue to run significant deficits in 2024 and beyond, continuing support for overall economic growth. The Congressional Budget Office (CBO) forecasts a 2024 deficit of $1.5 trillion or 5.3% of GDP.xvi

Tempered Fed Rate Expectations

Future Fed policy may also be helpful to 2024 GDP growth prospects; however, expectations for aggressive Fed rate cuts in 2024 have faded. Coming into the year, the Fed funds futures market anticipated 150 basis points (bps) of rate cuts in 2024.xvii The Fed also projected rate cuts in 2024, but a more modest 75 bps of cuts.xviii

However, inflation readings in 2024 have come in higher than expected. The Consumer Price Index (CPI) in March 2024 came in at 3.5% on a year over year basis, up from 2.9% in January. Similarly, core inflation (or Core CPI, which excludes volatile food and energy prices) has also come in higher than expected and was up 3.8% on a year over year basisxix. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, is also exhibiting signs of acceleration in the past few months. Important to note that these two indexes are constructed differently and tend to behave differently over time. The latest reading for the PCE Price Index and its core component were 3.4% and 2.8%, respectivelyxx. In summary, all inflation readings remain well above the Fed’s 2.0% target, and the rate of improvement appears to have slowed, if not reversed.

The higher-than-expected inflation readings have tempered Fed rate cut expectations for 2024. The Fed funds futures market now expects only 25-50 bps of rates cutsxxi. We suspect that Fed funds rate cuts were a component and a positive contributor to economic forecasters view of the trajectory of the U.S. economy, especially in the back half of 2024. Higher-than-expected interest rates could present a headwind to areas such as the housing market, capital spending plans, and the banking industry.

To be sure, the economy might not need Fed rate cuts to maintain its positive economic momentum. Since March 2022, the economy has endured 525 bps of rate increases, yet produced a median quarterly GDP of 2.6% (at an annualized rate).xxii

The economy might not need Fed rate cuts to maintain its positive economic momentum. Since March 2022, the economy has endured 525 basis points of rate increases, yet produced a median quarterly GDP of 2.6% (at an annualized rate).

Economic Outlook: No Recession, but Still Concerns

We, like most, continue to be pleasantly surprised by the resiliency of the U.S. economy and are incorporating a much more sanguine viewpoint into our outlook, but there are still some tangible risks to monitor. While we are optimistic that the economy will avoid recession in 2024, it is not without some concerns.

Fed’s Restrictive Policy

The Fed’s restrictive monetary policy stance since March 2022 continues to cloud the outlook. As mentioned, the economy has so far easily absorbed the 525 bp of Fed funds rate increases from March 2022 through July 2023—the largest and fastest rate increase since 1980. However, the impact of monetary policy involves “long and variable lags” that can take 9 to 24 months to impact the economy.xxiii

Further, with the recent pickup in inflation, there is a risk that the narrative switches from rate cuts to the need for a resumption of rate increases. Such a scenario would likely not be well received by the financial markets and could present a headwind for areas of the economy such as housing, capital spending, and the banking industry.

It's important to note that past Fed fund rate increase cycles have led to a slowdown in economic growth—and often recession.

Inverted U.S. Treasury Yield Curve

The U.S. Treasury yield curve remains inverted, which in the past has been a very good indicator of recession. Both the 2y – 10y U.S. Treasury spread and 3m – 10y U.S. Treasury spread continue to be inverted as of March 31, 2024, at -42 bp and -115 bp, respectively, and have been for an extended period. The Federal Reserve Bank of New York’s recession probability indicator, based on U.S. Treasury yield spreads, puts the probability of recession within the next twelve months at 58%.xxiv

While we are optimistic that the economy will avoid recession in 2024, it is not without some concerns.

Continued Challenges in Banking Industry

Although fallout from bank failures early in 2023 were contained and results of the Fed’s annual stress test on the country’s largest banks suggests these banks are sufficiently capitalized,xxv operating conditions remain challenging for the banking industry. Deposit outflows appear to have stabilized, but higher yielding competing products may continue to draw deposits out of the banking system. Banks need to replace these lost deposits with higher cost funding, which hurts profitability. Deposit outflows also present potential liquidity challenges.

In addition, banks continue to hold significant unrealized investment losses in their investment securities portfolios, and the recent increase in interest rates likely provided little relief. The combination of higher borrowing costs and reduced liquidity could serve to further tighten bank lending standards, which are already at levels historically associated with economic slowdown and recession.xxvi

Other Economic Indicators

Various other economic indicators also suggest caution is warranted. Consumer confidence levels, specifically the future expectations component, are at a level typically associated with recession.xxvii (We highlighted earlier that the present situation component of the consumer confidence levels is improving and relatively strong, but consumers outlook on the future is much dimmer.) Consumer savings levels are falling (suggesting consumers have exhausted excess COVID savings) and delinquency rates are rising.

Small business optimism is at a 10-year low. The National Federation of Independent Business (NFIB) Small Business Optimism Index is at its lowest level since 2012, citing inflation (higher input and labor costs) as a key concern. In addition, hiring plans have fallen sharply and at their lowest level since January 2021.xxviii

U.S. Government’s Fiscal Health

We are also a bit concerned about the U.S. Government’s fiscal condition and its potential to negatively impact government spending and tax policy, and in turn economic growth, in the years to come. The gross debt of the United States Government has grown $11.4 trillion, or 49%, since the end of 2019 (just before the pandemic) – and now stands at $34.6 trillion (as of 3/29/24).xxix

Due to the significantly higher debt levels and the sharp rise in interest rates over the past year, the Congressional Budget Office (CBO) estimates that net interest payment on the nation’s debt (or the cost to just service the debt) will rise to over 19% of total government revenue by 2025, up from 9.7% in 2022 and an average of 8.7% from 2013-2022. This has significant implications for government spending and tax policy in the years to come, especially given that the U.S. budget already operates in a significant deficit, which the CBO estimates to be approximately 13% of revenue in 2024, excluding net interest expense.xxx

Financial Markets

An improved economic outlook is supportive of corporate earnings and stock prices, but prospects for higher-than-expected inflation and interest rates may impact equity and fixed income valuations. Stock prices (as measured by the S&P 500) have rallied 27.6% from October 2023 lows as the prospects for both a better-than-expected U.S. economy and Fed rates cuts in 2024 came into view. The U.S. economy and corporate earnings remain positive, but the now faded prospects for subdued inflation and aggressive Fed rate cuts may present a headwind for valuation. Fixed income yields have moved higher as the economy and inflation outpaced expectations and Fed rate cut expectations have moderated. There is always the risk that yields move higher, but in general, we continue to see opportunity to extend duration in fixed income portfolios.

Fixed Income

The reemergence of inflationary pressures is pushing interest rates/yields higher, and additional increases are possible. Nevertheless, yields are attractive relative to their 15-year range, and we see opportunity to extend duration, but continue with a preference for high quality. Credit spreads are extremely tight and do not appear to adequately compensate investors for the added credit risk; as such, it may be too early to add exposure to lower-quality corporate bonds and other higher risk, credit sensitive segments of the fixed income market.

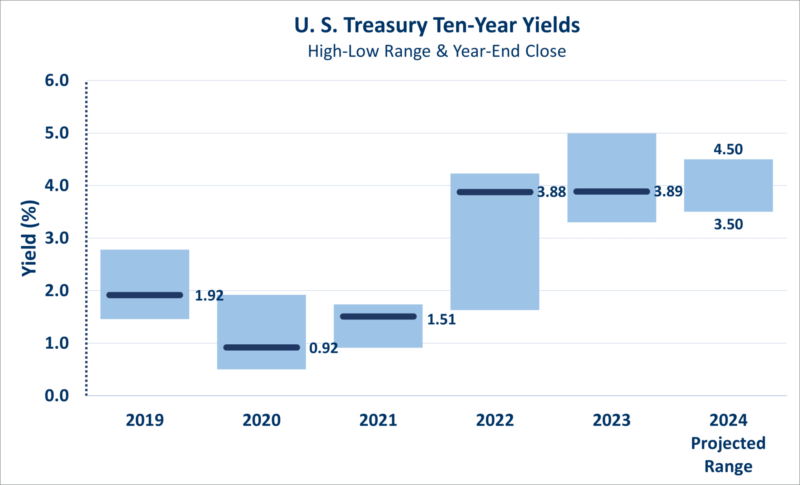

Yields. The 2-year Treasury yield increased 37bp in the quarter to end at 4.62%, down sharply from the 5.21% peak in mid-October 2023 but still at the high-end of the 15-year range of 0.09%-5.21%. The 10-year Treasury yield increased 32bp in the quarter to end at 4.20%, down sharply from the 4.99% peak in mid-October 2023 but still at the high-end of the 15-year range of 0.50%-4.99%.

Inflationary pressures have reemerged in early 2024. Continued increases in inflation readings could push rates higher and eliminate the prospect of Fed funds rate decreases in 2024—or even force the Fed to restart hikes. U.S. government debt issuance to fund large ongoing budget deficits could also serve to increase market interest rates if investors begin to demand higher risk premiums to offset the perceived risk of unsustainable spending and debt accumulation. Such scenarios would certainly present a headwind for fixed income returns.

Nevertheless, despite the recent pick-up, inflation is expected to moderate over the balance of 2024,xxxi providing opportunity for market interest rates to decline. We continue to see opportunity to extend portfolio duration and lock in some higher yields for the longer-term. Current high money market yields could evaporate quickly should the Fed have opportunity to pause and pivot. Timing the exact inflection point of peak yields is probably not the best investment strategy.

Credit spreads. Credit spreads are at the low end of historical ranges and do not appear to price in any hiccups in the economy; as such, it may be too early to add exposure to lower quality corporate bonds. Investment grade spreads at 90bp remain below the twenty-year average of about 149 bp and significantly below spreads during economic slowdowns and recessions. High-yield spreads at 299bp remain significantly below the twenty-year average of about 493bp, and significantly below spreads during economic slowdowns and recessions.

Equity

Better than expected performance of the U.S. economy has improved the outlook for corporate earnings growth in 2024; however, the continued rally in equity prices and relatively rich valuation leaves little room for any disappointment.

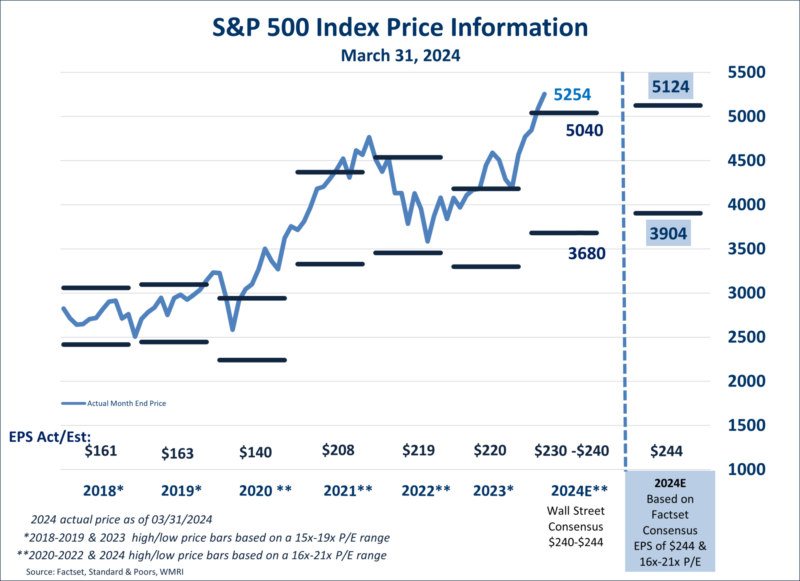

Corporate Earnings. Corporate earnings estimates still appear a bit too high in our opinion, but the continued strong performance of the economy is surely supportive of solid earnings growth. Current FactSet consensus S&P 500 earnings estimates call for 2024 earnings growth to accelerate to 10.7%, up from 0.4% growth in 2023xxxii.

The 2024 U.S. GDP growth estimate of 2.1%, up from a beginning of year estimate of 1.3%, certainly supports an acceleration in earnings growth; however, we view 10%+ earnings growth as a bit aggressive due to:

- Historical patterns in the trend of annual earnings estimates (i.e., calendar year earnings estimate tend to fall as the year progresses)

- The concentration of 2024 earnings growth among a relatively small number of companies (20 companies in the S&P 500 are responsible for approximately 80% of the S&P 500’s estimated net income growth in 2024), and

- Concerns about earnings growth estimates for certain sectors (e.g., the financial sector net income growth expectation of approximately 8% appears a bit optimistic, in our opinion).

We have a cautious outlook for stock prices from current levels. Corporate earnings are supportive, but the current price/earnings multiple of 21.5x leaves little room for any disappointing news.

Stock prices. We have a cautious outlook for stock prices from current levels. Corporate earnings are supportive, but the current price/earnings multiple of 21.5x leaves little room for any disappointing news. The rally in stock prices puts the current S&P 500 p/e ratio based on the consensus 2024 estimate at 21.5x. This is not a cheap valuation, especially in a still heightened inflationary and interest rate environment. There is an inverse correlation between inflation and p/e ratios. Higher inflationary environments typically result in lower p/e ratios. Therefore, if inflation and interest rates fail to fall in the coming year, then we see downside risk to valuation.

International Equity. We continue to underweight our exposure to international equities but see performance benefits from a weak U.S. dollar. Although valuations appear significantly lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global scale information and medical technology companies.

In addition, the Russian/Ukraine and Israel/Hamas conflicts have a much greater and direct impact on economies outside of the United States. Economic growth projections across Europe are relatively poor and below 1%. In the emerging markets, heightened risks keep us cautious—specifically, geopolitical risks related to China.

We do recognize a weaker U.S. dollar will boost unhedged international investment returns. The U.S. dollar increased 2.2% versus the Euro in Q1; however, the consensus forecast calls for dollar weakness in anticipation of lower U.S. inflation, a more accommodative U.S. Federal Reserve policy, and improving global economic growth relative to the U.S.xxxiii As such, we do see value in having some exposure to international equities.

As usual, the economy and financial markets present both opportunities and challenges; patience and a long-term perspective are helpful navigation tools. Please reach out to your Washington Trust team with questions about how the economy and market impact your portfolio and long-term financial plan.

i Federal Reserve Bank of Atalanta, GDPNow Estimate for 1Q:2024, April 16, 2024

ii FactSet, as of April 18, 2024

iii FactSet

iv FactSet

v An economic ‘soft landing’ is an economic slowdown that avoids recession.

vi Employment Statistics from FactSet & U.S. Bureau of Labor Statistics (BLS)

vii Personal Income Statistics from FactSet & Bureau of Economic Analysis (BEA)

viii Hourly Earnings Statistic from FactSet & BLS

ix Personal Expediture Statistics from FactSet & BEA

x The Conference Board, U.S. Consumer Confidence survey, March 26, 2024

xi The Conference Board, U.S. Leading Economic Index, March 21, 2024

xii Factset, Institute for Supply Management (ISM) Purchasing Managers’ Index (PMI), March 2024

xiii Refers to the period of stress in the global banking system in 2007 thru 2009

xiv Factset, National Association of Realtors, March 2024 report

xv Factset

xvi U.S. budget data and forecast from the Congressional Budget Office. The Long-Term Budget Outlook: 2024 to 2054, March 2024

xvii CME Fed Watch Tool, January 8, 2024

xviii FOMC Meeting, December 2023

xix CPI statistics from FactSet, BLS

xx PCE Price Index statistics from FactSet, BEA

xxi CME FedWatch Tool, April 10, 2024

xxii Factset

xxiii Federal Reserve Bank of St. Louis, “Examining Long and Variable Lags in Monetary Policy’, Bill Dupor, May 24, 2023.

xxiv FactSet, Federal Reserve Bank of New York

xxv Board of Governors of the Federal Reserve System, 2023 Federal Stress Test Results, June 2023

xxvi FactSet, Federal Reserve, October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

xxvii FactSet

xxviii NFIB, Small Business Economic Trends, March 2024

xxix U.S Department of the Treasury. Fiscaldata.treasury.gov

xxx Congressional Budget Office. An Update to the Budget Outlook: 2023 to 2033, May 2023

xxxi FactSet Economic Estimates, April 16, 2024

xxxii FactSet Earnings Insight, April 5, 2024

xxxiii FactSet

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.