Q1 Economic and Financial Market Outlook

January 18, 2023

By: Peter R. Phillips, CFA®, CAIA®,

Senior Vice President and Chief Investment Officer,

Washington Trust Wealth Management

After an extremely volatile 2022, what can you look forward to in 2023?

2022 Recap: Good Riddance

A confluence of events – including a pandemic, geopolitical crisis, and labor shortages – resulted in sustained and higher than expected levels of inflation, forcing the Federal Reserve to pivot aggressively to a restrictive monetary policy position, leading to a spike in interest rates and havoc in the financial markets.

The Fed initially viewed inflationary pressures as “transitory,” but was eventually forced to pivot aggressively towards a more restrictive monetary policy position. The Fed entered the year expecting to make three 25 basis points (bp) Fed funds rate increases in 2022. Instead, the Fed raised the Fed funds rate seven times, four of which were in 75 bp increments, the largest single meeting point increases since 19941.

Nowhere to Hide

Yields/interest rates spiked (the largest calendar year yield increase over the past 60 years2), sending bond prices, which move inversely with yields, down sharply. Stock valuations, which historically are inversely correlated with inflation, fell resulting in sharply lower stock prices. Double-digit declines were experienced across asset classes, leaving investors with few places to hide. Even diversified balanced portfolios suffered double-digit declines. A hypothetical 60% U.S. large stock/40% U.S. government intermediate-term bond portfolio fell 14.6% -- the 4th worst return in 97 years.3

Teetering on a Recession

The U.S. economy avoided recession in 2022, but the roughly 2.0% GDP growth rate expected for 2022 is much lower than beginning-of-year consensus estimate of about 4.0%4. Pent-up consumer demand emerging from two years of COVID restrictions, combined with a strong labor market, kept consumer spending strong, offset by high energy and food prices and weakness in the housing and auto markets.

A sustained and elevated level of inflation is detrimental to the economy. It negatively impacts consumers’ purchasing power and their standard of living, especially those with lower and/or fixed incomes. Restrictive monetary policy can act to cool consumer demand and in turn, inflationary pressures. |

2023 Outlook: The Good and the Bad

Higher Fed funds and market interest rates present a significant headwind for U.S. economic growth. While the Fed’s restrictive monetary policy stance heightens the risk of a recession, optimists believe the strong labor market may help avoid one.

More Fed Impact

The Fed is likely not done with Fed fund rate increases, and the next easing cycle may not begin as quickly as the market anticipates. Inflationary pressures, while moderating, remain near 40+ year highs. Food and shelter price increases, which make up approximately half of the CPI Index, remain stubbornly high.

On a positive note, oil prices –which ended the year down 35% from the peak early in 2022 and only 6% higher than the start of the year – have continued to fall in early 2023 and are now down about 5% from a year ago.5 This should help cool inflation and help consumers’ pocketbooks in the coming months.

Fed officials have suggested in recent projections and commentary that the Fed funds rate will need to move to at least 5.0% (up from the current target rate of 4.25%-4.50%) and stay there for an extended period to combat inflation pressures. U.S. Federal Reserve Chairman Jerome Powell has been clear in communicating his intention to bring inflation back to target levels (2.0%) and that it is premature to think about a Fed “pivot” to a more neutral/accommodative stance.

Fed policy is likely to slow the U.S. economy and keep financial markets volatile.

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.” – Fed Chair Jerome Powell, November 30, 2022. Inflation and the Labor Market, Speech at the Hutchins Center on Fiscal and Monetary Policy, Brookings Institution, Washington, D.C. |

Economic Lag

Because Fed policy impacts the economy with a lag, the full effects are not yet known. Certain areas have already been negatively impacted, including the housing market and auto sales. The 30-year fixed rate mortgage more than doubled from 2021, ending the year at approximately 6.66%, resulting in a sharp contraction in housing market activity6. Existing home sales are down 35% over the past year7. On a positive note, the supply of existing homes for sale at 3.3 months, while double from 2021, is still at a relatively low level and providing some support for home prices8. Auto sales have been negatively impacted for most of the pandemic due to supply shortages. New vehicle sales continue to be stuck at about 80% of the pre-pandemic level, and higher interest rates are unlikely to provide any tailwind.

Recession Outlook

The probability of a U.S. (and global) recession in 2023 is high – and the prospect of a soft-landing is “narrowing.” From our viewpoint, there are too many indicators pointing to economic slowdown and/or recession to ignore. Fed tightening cycles and inverted U.S. Treasury yield curves have typically been followed by recession. In addition, key indicators of economic activity are now starting to indicate a broader slowdown may lie ahead. The Institute for Supply Management (ISM) Indices weakened throughout 2022 and now suggest both the manufacturing and services sectors of the economy are beginning to contract9. Consumer Confidence surveys also suggest a less optimistic consumer and the potential for a slowdown in the months ahead10.

The outlook for economic growth outside the U.S. is equally subdued and exacerbated by additional factors, including the war in Ukraine, which has a significant impact on global energy and food supplies, and China’s former zero-COVID policy, which has negatively impacted China’s growth and global supply chains. |

We expect U.S. GDP growth in 2023 to slow significantly from the roughly 2.0% growth rate expected for 2022. The Factset consensus 2023 U.S. GDP annual GDP estimate is 0.3%, with slightly negative growth in each of the first three quarters of 2023 and recovery beginning in late 2023. This seems to be a reasonable forecast, although one with significant uncertainty. We will certainly follow conditions closely and alter our views as appropriate.

But there are positives. Optimists point to the strong labor market as a reason the U.S. economy may avoid a recession. The U.S. economy continues to create a respectable number of jobs – over 200,000 per month – and the unemployment rate at 3.5% continues to hover near all-time lows. With 4.5 million jobs gained in 2022, on top of 6.7 million in 2021, employment is now about 1.2 million jobs above the pre-pandemic level11. And with a tight labor market, some postulate that this may keep employers from laying off workers even if weaker economic conditions emerge.

And even if we fall into recession, pent-up consumer demand, a relatively robust U.S. labor market, strong corporate balance sheets, and a well-capitalized banking system indicate that we may avoid a deep recession. The anticipated slowdown in economic growth is more about supply scarcity, inflation, and Fed policy, rather than a lack of demand. While still unpleasant, this seems more benign than a complete shutdown of the global economy (2020) or the potential collapse of the banking system (2008-2009). Recessions are an unescapable part of our economic cycles, and we inevitably weather the storm.

Financial Markets

In general, we maintain our near-term cautious outlook for both the equity and fixed income markets but see an opportunity to get more constructive as we go through 2023. Volatility remains extraordinarily high as investors juxtapose higher interest rates, slower economic growth, and lower corporate earnings with the near-term uncertainty on Fed policy.

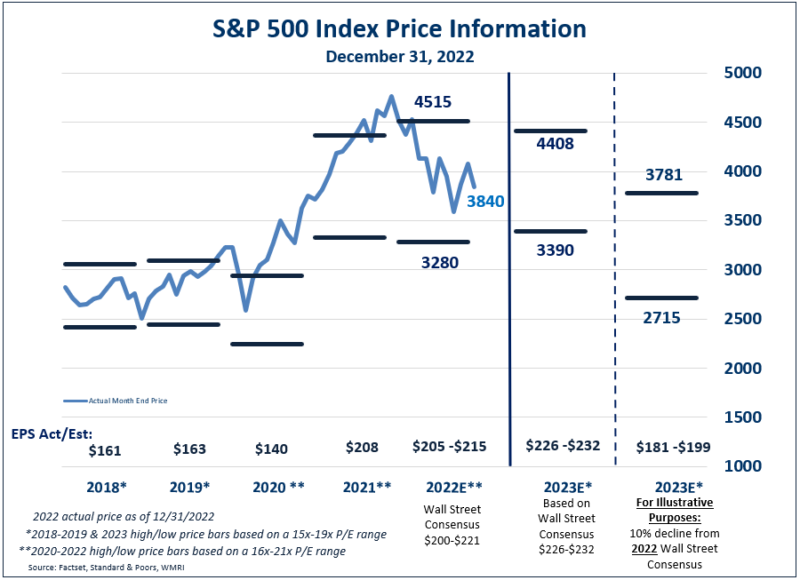

Although stock valuations have contracted significantly, we expect earnings estimates to fall, which could lead to further downward pressure on stock prices. Additionally, we expect stock price volatility to remain elevated as investors looking for “pivot” points evaluate earnings results, economic data, and Fed “speak,” which will undoubtedly provide fodder for both bulls and bears – and a bull and bear tug of war.

Fixed Income

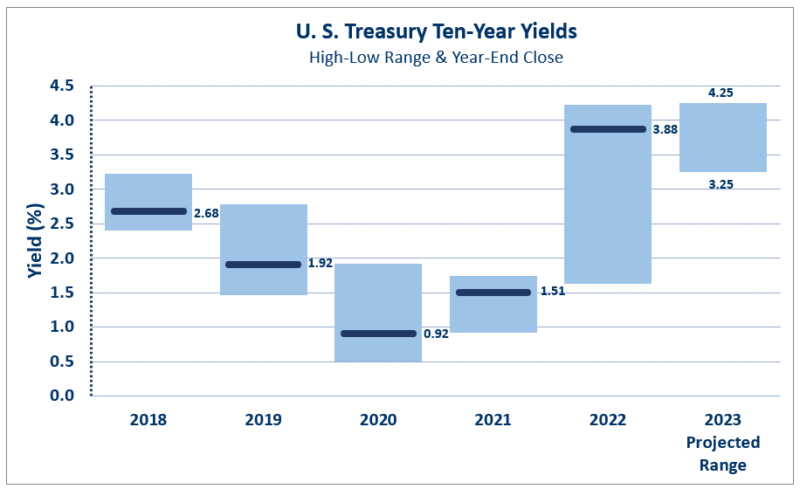

We continue to have a cautious view of the fixed income market and maintain a preference for low duration and high quality. However, with yields near 15-year highs and elevated recession risk, it may make sense to begin to add some duration to portfolios. The 2-year Treasury ended 2022 yielding 4.42%, the highest yield in about 15 years and up from a low range of 0.10%-0.20% during early 202112. The 10-year Treasury ended 2022 yielding 3.88%, the highest yield in about 12 years and up from a low of 0.51% in August 202013. Although yields could move higher, an economic slowdown and/recession would likely reduce Fed funds rate expectations and create a “flight to quality,” both of which would likely result in lower bond yields and positive returns for fixed income investments.

Given the probability of recession and likely widening credit spreads, it may be too early to add exposure to lower quality corporate bonds and other higher-risk, credit-sensitive segments of the fixed income market. High yield spreads increased 186bp in 2022, but at 469bp remain slightly below the twenty-year average of about 504bp, and significantly below spreads during economic slowdowns and recessions14.

U.S. Equity

Volatility remains extraordinarily high as investors juxtapose higher interest rates, slower economic growth, and lower corporate earnings with the potential for a Fed “pivot” to more accommodative policy. In our opinion, corporate earnings estimates are too high and inconsistent with economists’ consensus forecast for an economic slowdown and/or recession. Current consensus S&P 500 earnings call for 2023 earnings growth of 4.5%, following a 5.7% growth rate expected in 202215; however, economic slowdowns and recessions typically result in EPS declines. The median EPS decline during recession is 22%.16

The equity market is forward looking, and stock prices will typically recover prior to the trough in both economic activity and corporate earnings. Based on consensus forecasts, these troughs could be in mid-to-late 2023. |

The S&P 500’s price/earnings (p/e) ratio (valuation) compressed significantly in 2022; however, high levels of inflation and interest rates may keep downward pressure on valuation. There is an inverse correlation between inflation and p/e ratios, with higher inflationary environments typically resulting in lower p/e ratios. The current S&P 500 p/e ratio based on the 2023 FactSet consensus estimate is 16.7x, a relatively reasonable valuation in a modest inflationary environment17. If inflation fails to subside in the coming year, then we see downside risk to valuation.

International Equity

We continue to underweight our exposure to international equities relative to a global benchmark. Although valuations appear lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global scale information and medical technology companies. Having less exposure to higher growth technology industries may prove beneficial in the current market environment that has been specifically harsh on growth stocks; however, our preference is to position portfolios for the long-term and with a bias towards growth. In addition, the Russian/Ukraine conflict has a much greater and direct impact on economies across Europe, where recession risk is elevated. In the emerging markets, heightened regulatory and geopolitical risks keep us cautious - specifically the Chinese government’s COVID policies and recent regulatory crackdown on large information technology companies.

Despite this generally cautious view on the fundamentals of international equities relative to U.S. equities, a weakening U.S. dollar could provide a tailwind to U.S. investor’s international investments. An almost two- year long rally of 22% in the value of U.S. dollar reversed in late 2022, and the U.S. dollar has now declined 11% versus the Euro, which is providing a nice relative performance boost to international equities18.

A Word of Reassurance

While aggressive and restrictive Fed policy could trigger a recession in early 2023, there is reason to believe we could expect equity market gains and a rebound by late 2023 to early 2024. Bear markets are inevitable, and while it’s tempting to change your investing strategy when things aren’t going well, the worst mistake investors make in volatile markets is to lose sight of their long-term financial strategy and focus on the short-term. Staying the course with a sound, long-term financial plan—investing in the market for the financial marathon, not a sprint—will help you ride out downswings, potentially preserve your assets, and capitalize on upswings.

In over 200 years of wealth management, there is one thing we know for certain: Eventually, the market will recover.

If you’re concerned or have questions about how the market and economy are impacting your portfolio, your Washington Trust team is here to help.

1 Factset

2 Based on 10-Year U.S. Treasury yields. Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org

3 Morningstar. U.S. large stocks represented by Ibbotson U.S. Large Stock Index and U.S. government intermediate-term bond represented by the Ibbotson Intermediate Term U.S. Government Bond Index

4 Factset

5 Factset, as of 1/10/2023

6Factset, Bankrate

7 Factset. As of November 2022

8 Factset, National Association of Realtors, November 2022

9Factset, Institute for Supply Management

10Factset, The Conference Board, University of Michigan, December 2022

11Factset, U.S. Bureau of Labor Statistics, December 2022

12Factset

13Factset

14Factset. As of 12/31/22. High yield represented by the Bloomberg Corporate High Yield Index

15Factset

16Strategas

17Based on the 12/31/22 S&P 500 closing price of 3840 and the Factset consensus 2023 S&P 500 EPS estimate of $230.

18Factset

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.