Financial Literacy for the Next Generation

April 20, 2022

You want your children and grandchildren to become financially savvy adults who are empowered to control their wealth. But how will they learn all they need to know?

There is a good chance they will not learn financial literacy in school. Less than 17% of high schoolers across the country are required to take personal finance. In fact, it wasn’t until 2021 that Rhode Island Governor McKee signed a law requiring statewide academic standards for the instruction of consumer education in public high schools, and beginning with the graduating class of 2024, that all students demonstrate proficiency in consumer education prior to graduating high school.1

In addition, technological advancements are making it increasingly difficult for children to learn about money simply by watching their parents. For example, your children see you fill your grocery cart with food, tap your credit card, and head to the car. As far as they’re concerned, no money changed hands. And the prevalence of Venmo, Apple Pay, Uber, and other electronic payment systems make it increasingly difficult for your children to understand that you’re actually paying the babysitter, car service, and other providers, because they don’t witness the back-end transactions.

This means that financial literacy must be actively taught at home, and your Washington Trust Wealth Advisor is a resource you can count on to guide you.

In honor of Financial Literacy Month, an annual campaign in April to promote financial education, we share lessons that can help children of all ages.

Money lessons for all ages

You can empower your children with age-appropriate money messages that encourage healthy money habits and teach them about saving, investing, and giving back. Your Washington Trust Wealth Advisor is available to facilitate more in-depth conversations about wealth management with your family.

Preschool. Children learn through play during the preschool years and are ready to understand the concept of money. Ideas for teaching them about money include:

- Play “store” with them and talk about how much each item costs, so your children realize that money is necessary to buy things.

- Show your children examples of U.S. currency and what each denomination is worth, so they learn to identify coins and bills.

- Talk about different careers and how people earn money by doing their job. If you take your child with you on an errand, you can play a version of “I Spy” pointing out the different careers. For example, I see a letter carrier, I see a police officer, I see a librarian, I see a doctor, I see a store owner, and so forth.

Elementary school. At this age, your kids may be old enough to start doing extra chores around the house and start receiving an allowance. (Whether allowance is tied to chores is a personal decision made by each family). If you think it’s appropriate, you can give your child options for how to spend his or her money and share your values about allocating a portion of funds to savings and charitable giving.

Young teenagers. The middle school and early high school years are a time when children are eager to fit in by buying the latest fashions or video games. They may benefit from a conversation about budgeting for “needs” versus “wants.”

Needs |

Wants |

Food for sustenance |

An ice cream cone |

Shelter |

A swimming pool |

Clothing |

The latest fashion trend |

Love and friendship |

Nintendo DS |

Ability to communicate |

iPhone |

It’s also a good time to encourage your child to get an age-appropriate part-time job, such as baby-sitting, working as a camp counselor, or tutoring a younger student. Lessons about spending become more meaningful when your child sees what it takes to earn money.

Pre-college years. Before your children head to college and are presented with the opportunity to get a credit card in their own name, make sure they understand the implications of revolving credit, how long it takes to pay off a balance when you only pay the minimum due, and how to spend responsibly. Having one’s own credit card can be a valuable way to build credit, but kids who don’t understand how credit cards or compounding interest work can get into trouble fast.

It can help to give them an example. Let’s say your child goes on spring break and does a little shopping beforehand, racking up a $1,000 balance on his or her new credit card. Assuming he or she pays only the minimum due each month, it will take five years to pay it in full and the trip will have cost $1,439 with interest. Should your child continue to spend and accumulate $4,000 in balances, he or she will end up paying a total of nearly $6,000 in charges.

Credit Card Charges |

Minimum Monthly Payment (estimate) |

Interest Rate (average for credit card plans assessed interest) |

Total payment made |

Time to pay off balance |

$1,000 |

$25 |

16.45%2 |

$1,439 |

5 years |

$4,000 |

$94 |

16.45%2 |

$5,947 |

5 years |

Source: Credit Card Payoff Calculator, Experian |

||||

College years. When your children become young adults preparing to launch their own careers, they are ready to learn about investing. One of the most valuable lessons is the power of compounding interest. Teaching them about spending today versus investing for tomorrow can put them on track for a more secure future.

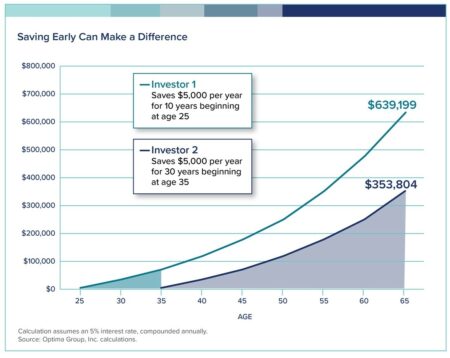

For example, as you can see in the scenario below, Investor 1, who starts to save at age 25 and saves for ten years ends up with significantly more money at age 65 than Investor 2, who saves for thirty years but doesn’t begin until age 35.

An early start can have a significant impact in the long run. You can help your children prepare for a successful retirement by making sure they understand the power of compounding interest, and we are here to help.

Age of majority. When children with trust funds reach the age of majority (18 years of age in CT, RI, and MA), or graduate from college and launch their own careers, they may be ready to begin discussing investing and wealth planning.

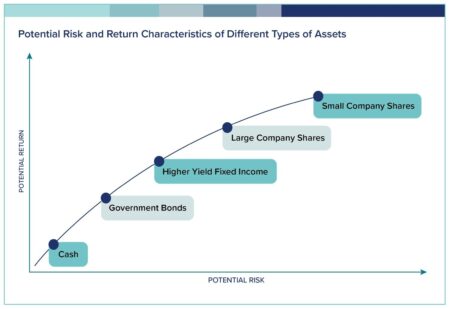

A Washington Trust Wealth Advisor can explain the different asset types that comprise an investment portfolio and the potential risk and return characteristics of each. We can facilitate a conversation about our approach to long-term investing, the importance of creating an asset allocation aligned with their goals, and how we take advantage of investment opportunities we see.

Any age. Philanthropic giving is a lesson about family values that can begin at a young age. Your Washington Trust Wealth Advisor can help bring your family together for a conversation about what wealth means to you, your views on helping those less fortunate, and how to give strategically as a family. We can also talk to your older child about the different options for giving, including cash donations, appreciated securities, Charitable Remainder Trusts, Charitable Lead Trusts, and Donor Advised Funds (DAFs) and the benefits and suitability of each.

In addition, your child should know how to review non-profit organizations to ensure they are reputable organizations that use their funds effectively, leveraging third-party non-profit evaluators, such as Charity Navigator.

When your child is ready. Speaking with your children about your family’s wealth can be complicated. On the one hand, you want to prepare them for the assets they will receive. On the other hand, you want to make sure they are motivated to achieve their own success. Your Washington Trust Wealth Advisor is a resource you can rely on to guide a conversation with you and your children about wealth planning, values, and your hopes and dreams for their future.

Washington Trust Wealth Management is committed to the financial well-being of your whole family, including the next generation. Please reach out to your Washington Trust Wealth Advisor if you’d like to schedule a conversation.

1 Financial Literacy | Rhode Island Department of Education (ri.gov)

2 Consumer Credit, Federal Reserve Statistical Release, February 2022, April 7, 2022

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

By accessing the noted link you will be leaving Washington Trust's website and entering a website hosted by another party. Washington Trust is not responsible for, nor do we control, endorse or guarantee the content of any external sites. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Washington Trust's website. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of Washington Trust.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.