Fall 2021: Economic & Financial Market Outlook

October 20, 2021

Economic Recovery is Expected to Continue Despite Near-Term Challenges

The resurgence in the economy that began last year is expected to continue boosted by strong consumer demand, rising wages, and low financing costs. While we are confident in this outlook, we are monitoring several developments that may impact our view.

COVID-19 MAKES A COMEBACK

New COVID-19 cases, hospitalizations, and deaths spiked in late summer, raising concerns for the need to reimplement stricter social distancing measures. The momentum of the economic recovery slowed as some people became uncomfortable with going back to work or engaging in public activities generally, such as travel.

Nevertheless, good news in the battle against COVID-19 is undeniable. Vaccinations have proven to be quite effective in preventing infection and hospitalization – and despite the political noise, a majority of those eligible for vaccination in the U.S. are either already vaccinated or plan to get vaccinated soon.

Also, pharmaceutical giant Merck and partner Ridgeback Biotherapeutics recently announced very favorable results from an ongoing Phase III study of an oral antiviral medicine that reduces the risk of hospitalization or death by 50% in patients with mild-to-moderate COVID-19.

COVID-19 is not going away anytime soon and the potential for new strains coupled with the low vaccination rates outside the developed nations remain concerning. We are hopeful, however, that continued vaccination progress and effective antiviral medicines will at least keep the COVID-19 pandemic manageable.

UNSETTLING EVENTS IN CHINA

Some recent events in China have had negative impacts on world markets. Evergrande, China’s second- largest property developer with over $300 billion in debt, is at risk of default, which would likely stall economic growth in China and have a negative impact on the global economy as well.

The Chinese government is also stepping up regulation over certain aspects of its economy – from internet firms’ privacy practices to the amount of time citizens are allowed to play video games. Specific attention has been focused on the high-growth tech sector, including a recent declaration that cryptocurrency transactions are illegal. In addition to these internal developments, the relationship between the U.S. and China seems to be deteriorating. Negotiations on items such as trade and financial market regulation appear strained, creating renewed uncertainty in our economy and financial markets.

U.S. FEDERAL RESERVE: RISING RATES AND A POTENTIAL LEADERSHIP CHANGE

At the September FOMC meeting, the U.S. Federal Reserve (the Fed) suggested it would soon moderate its pace of asset purchases (quantitative easing). This will reduce demand for Treasury securities and potentially increase yields. No change to the Fed Funds rate is imminent, but the first increase is expected sometime in 2022.

Chairman Powell’s term expires in February 2022. His renomination is in jeopardy due to recent controversies regarding the personal securities trading of several Federal Reserve Bank presidents and the perception of many progressive Democrats that Powell’s policies on bank regulation, climate change and other key issues are too lax. A new Fed chair, especially with progressive views, could result in a significant change in U.S. monetary policy that would certainly impact financial markets.

POLITICAL WRANGLING IN WASHINGTON, D.C.

Although there was bi-partisan agreement on a $1 billion plus infrastructure spending bill, political differences on the much larger social spending bill (even within the Democratic party) have led to a stand-off for the moment. Ultimately, some compromise is likely on a ‘watered down,’ but still massive ($1.5-$2.3 trillion) social spending bill.

Along with the infrastructure and social spending bills, there are likely to be increases to corporate, individual, and estate income tax rates. The added taxes will be used to offset spending and, therefore, are expected to have a limited impact on economic growth. However, outlays will be spread over multiple years (7-10), while tax hits are immediate, very likely leading to lower S&P 500 earnings in 2022.

The debate over raising the debt ceiling could have the most immediate and severe financial market impact. Congress has agreed on a small increase to the debt ceiling that will provide the U.S. Treasury another two months or so of financing; however, a longer-term solution is needed. Should Congress not act by early December, the U.S. Treasury may not have the ability to pay interest and principal on U.S. debt or to pay for Social Security and other government benefits. Interest rates across the entire economy would likely spike, stock prices would fall, and a recession may ensue. We believe this to be a low probability event given a U.S. Treasury default is a politically untenable position for either political party. But the possibility for the worst remains given that political discourse and compromise in Washington are arguably at all-time lows.

SUPPLY CHAIN DISRUPTIONS

Supply chain bottlenecks throughout the economy have been slowing growth and increasing pricing pressure. Problems related to semiconductor shortages and automobiles have been well documented in the media. A shortage of available truck and delivery drivers is also exacerbating the supply chain problem. The good news is that this is demand driven and is a positive indicator of the underlying health of the economy, but in the short term, it is a drag on the recovery.

THE STATE OF THE FINANCIAL MARKETS: THE RECOVERY TO CONTINUE

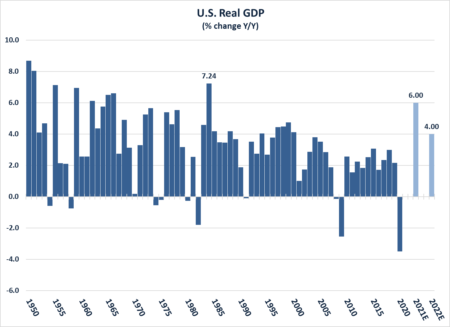

Despite the many challenges facing the U.S. economy, we expect the recovery to continue into next year, albeit at a bit slower pace. We have lowered our U.S. GDP growth expectations for 2021 to 5.5%- 6.0% (from 6.5%-7.0%), but this would still be the best annual growth rate since 1984. Further, the consensus estimate for U.S. GDP growth in 2022 is 4.0%, which, excluding 2021, would be the best year for U.S. economic growth since 2000.

Source: Factset

Several positive economic factors support our optimistic outlook. Retail sales (ex. auto sales) remain robust. Existing home sales, while off recent highs, are still above pre-pandemic levels and the best in over a decade. Home prices are up double digits year over year and well above pre-GFC levels. And despite the bottlenecks, the industrial side of the economy is booming as well. Durable goods orders (ex. transportation) are at all-time high levels.

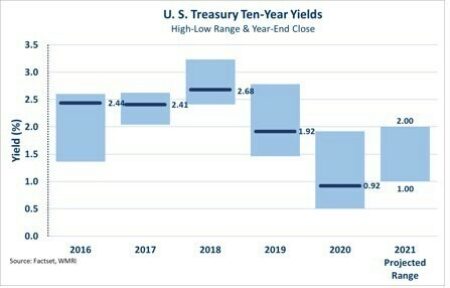

For fixed income investors, short-term yields remain close to historic lows reflecting the Federal Reserve’s fed funds rate policy with rate targets currently at 0%-.25%. The Fed expects to begin to shift its fed funds rate policy upward in 2022, in response to improved labor market conditions and inflation levels. But if debt ceiling negotiations in Congress stall or breakdown, expect to see short-term rates rise prematurely in response to the higher probability of default.

We expect longer-term yields to continue to move higher in 2021 and possibly into 2022 driven by both inflation and a Fed withdrawal of its bond purchasing programs (quantitative easing). CPI (core) is currently at 4.0%, making 10-year ‘real’ yields significantly negative. We would not expect such extreme negative real yields to persist for an extended period, especially with the current upward pressure on inflation.

We continue to prefer shorter duration, high quality fixed income exposure to protect from an increase in rates and a widening of credit spreads. Both Investment Grade and High Yield Corporate spreads, 0.84% and 2.80% respectively, are close to all-time low levels and may not provide adequate compensation for the inherent credit risk.

We have also added an international emerging markets debt fund to our approved line up of fixed income options; however, like conditions in the U.S. High Yield market, spreads are tight overseas and may not provide adequate compensation for the inherent credit risk. Such fixed income options may provide a higher current yield, but exposure should be commensurate with an investor’s risk tolerance.

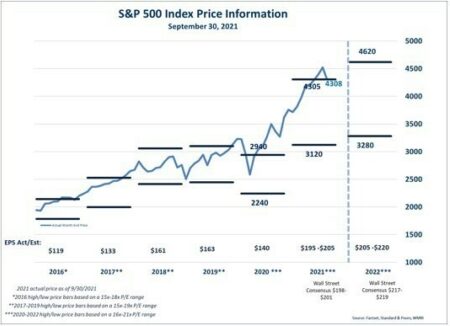

Our outlook for stock investors is cautiously optimistic. We expect some slowdown in earnings growth and see risk to the current valuation level. Nevertheless, low interest rates and a lack of attractive investment alternatives may provide near-term support for stock prices.

Although stock prices fell almost 5% in September, the S&P 500 has still managed to return 15.9%, including dividends, through the first three quarters of 2021. The consensus bullish narratives related to the economy and corporate earnings growth in 2021 remain intact and are helping drive stock prices higher, despite the emergence of the COVID-19 Delta variant and a recent increase in new infections. Accommodative U.S. Federal Reserve policy, coupled with aggressive stimulus and investment spending from Washington, D.C. are also key drivers.

Should the economic recovery continue with minimal disruption, we would expect ‘value’ stocks and stocks exposed to ‘re-opening’ themes to outperform, while ‘growth’ stocks take a breather from their recent market leadership. Nevertheless, we prefer to be long-term equity investors, and, therefore, have a bias towards companies with long-term secular growth potential and/or long-term dividend growth potential.

1 – FactSet

2 - FactSet & WMRI

3 - FactSet, Standard & Poor’s, & WMRI

The views expressed here are those of Washington Trust Wealth Management and are subject to change based on market and other conditions. Investment recommendations and opinions expressed in these reports may change without prior notice. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Investing entails risk, including the possible loss of principal. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions.

Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. Past performance does not guarantee future results and the opinions presented cannot be viewed as an indicator of future performance. The S&P 500 Index is an unmanaged index and is widely regarded as the standard for measuring large-cap U.S. stock-market performance. In addition, the S&P 500 Index cannot be invested in directly and does not reflect any fees, expenses or sales charges. Further, such index includes 400 industrial firms, 40 financial stocks, 40 utilities and 20 transportation stocks. The information we provide does not constitute investment or tax advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Please consult with your Portfolio Manager, Financial Counselor, Relationship Manager, attorney or tax professional regarding your specific investment, legal or tax situation.

The opinions expressed in this blog are those of the author and may not reflect those of Washington Trust Wealth Management. The information in this report has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. Any opinions expressed herein are subject to change at any time without notice. Any person relying upon this information shall be solely responsible for the consequences of such reliance. Performance is historical and does not guarantee future results.

Such information does not constitute legal or professional advice as all situations are unique and are based on individual facts and circumstances.

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.