Economic & Financial Market Outlook

January 20, 2022

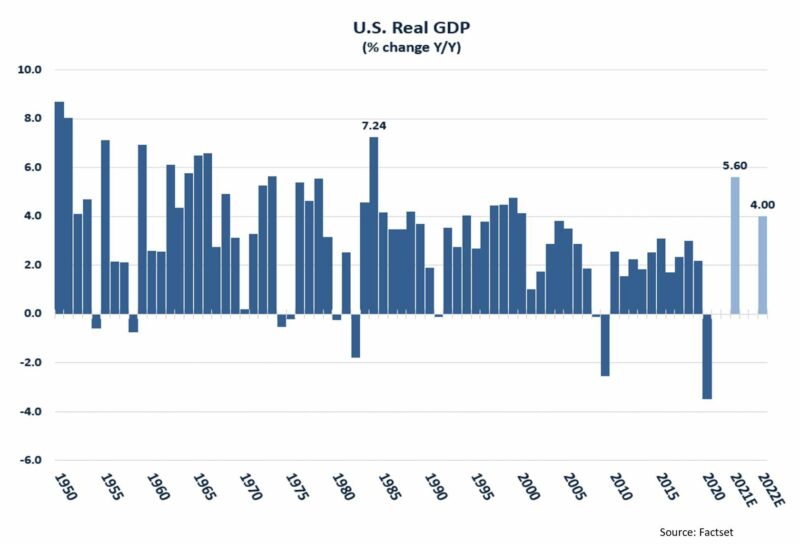

When the final tally is in, we expect GDP growth of 5.5% to 6.0% for 2021, both for the U.S. and the global economy1. If our estimate is on the mark, 2021 would go down as the best year for U.S. economic growth since the early 1980s and the best year for global growth since the 1970s. This is a remarkable result, given the emergence of both the Delta and Omicron strains in the back half of the year.

Looking forward, our outlook for the economy remains positive. Consensus estimates call for close to a 4.0% gain in U.S. GDP in 2022, making it one of the strongest years for economic growth in the last 20 years. Fueling growth in the new year is a rebounding labor market with rising personal incomes. But COVID-19 still remains a risk and Federal Reserve policy is likely to become less accommodative as the year progresses.

Back to work

A strong labor market and personal income gains should help keep economic momentum positive in 2022. While the recovery of the labor market has been slower than expected, it’s still been robust, and we expect additional improvement through 2022.

The U.S. economy gained approximately 6.5 million jobs in 2021 and the unemployment rate dropped from 6.4% to 3.9%, approaching historically low levels. However, we remain approximately 3.6 million jobs below pre-pandemic levels and there are still about 10.5 million job openings in the U.S.2

Job gains have not been even across the economy with employment levels in certain service areas of the economy well below pre-pandemic levels – specifically: transportation; food and lodging; nursing care facilities and child day care. These service areas of the economy, as well as manufacturing, look poised for additional improvement as consumer demand remains strong and we continue to find ways of “living with COVID-19.”

Extended COVID-19 related unemployment benefits from the federal government have ended and the prospect of additional large-scale stimulus out of Washington has dimmed. Wages are also on the rise. These factors may encourage more folks to enter or re-enter the job market, suggesting room for additional recovery in the labor market and continued economic momentum into 20223.

Labor drives spending

A strong labor market is supportive of personal income growth, which is up over 7% year-over-year despite the removal of pandemic-related unemployment benefits. Personal spending, in turn, remains healthy, up over 10% year-over-year and spread across most areas of the economy4.

Housing market activity too remains vibrant. Existing and pending home sales are close to historically high levels, despite concerns of labor and building supply shortages.

COVID-19 risk persists

COVID-19 remains a key risk to the economic outlook, but we remain optimistic on the effectiveness of the vaccines and new treatment therapies.

We are still in the early days of the Omicron variant, a COVID-19 strain that has proven to be highly transmissible, even in vaccinated populations. New infections are growing at a much higher rate than in earlier waves of the virus, but fortunately, the rate of hospitalization and serious illness appears lower5. We remain hopeful that vaccinations, boosters, and improving therapeutics will keep the pandemic manageable and allow most governments to avoid instituting more stringent restrictions on normal activity.

However, even without the imposition of new restrictions, self-quarantines due to illness or exposures could exacerbate existing labor shortages and production bottlenecks, negatively impacting economic momentum in early 2022. As we enter the third year of the pandemic, COVID-19 is not going away anytime soon and continues to be a significant risk to our health and that of the domestic and global economies.

The Fed puts the brakes on

Strong labor market conditions and elevated inflation readings may lead to a faster than expected reduction in the Fed’s accommodative policies. The Fed is now expected to end its bond-buying program (quantitative easing) by March, and, in fact, may begin reducing its balance sheet in 2022. Fed officials also expect three 25 basis point rate increases in 2022 with the initial rate hike to come as soon as March. This is a significantly accelerated timeline from expectations back in September when most Fed officials did not anticipate the need for a rate increase until 20236.

The Fed’s less accommodative stance is likely to put upward pressure on both short-term and long- term interest rates. This has negative implications for economic growth and both fixed income and equity market performance.

The State of the Financial Markets: Cautious Optimism

Fixed Income

Our fixed income outlook has not changed. Yields in fixed income remain historically low, but we expect higher yields as we go through 2022.

Short-term yields have risen sharply since late summer, reflecting market expectations for the Fed to begin increasing the fed funds rate in 2022. On January 7, the 2-Year Treasury yield rose to 0.87%, up from just 0.29% on September 30, 2021.

Short-term yields are influenced by and anchored to Fed policy. Recent Fed meeting minutes suggest that the Fed may act quicker and more swiftly than the market was anticipating in response to improved labor market conditions and rising inflation levels. We will continue to closely monitor economic statistics for signs that the Fed will further amend its current forecasts and action plans.

Long-term yields are up from their all-time lows in March 2020. The 10-Year Treasury yield hit 1.77% on January 7, 2022, more than triple its March lows and nearly double the 0.92% of December 31, 2020.

We expect longer-term yields to continue to move higher in 2022, driven by both inflation and a fed withdrawal of its bond purchasing programs (quantitative easing). CPI (core)7 is currently at 5.0% on a year-over-year basis, the highest reading in over 30 years, making 10 year ‘real’ yields significantly negative. We would not expect such extreme negative real yields to persist for an extended period, especially given the now somewhat dismissed viewpoint that current inflation levels are merely transitory.

The Fed has suggested it may not only end its current bond purchase program by March 2022 but may also sell additional securities to reduce the size of its balance sheet. This would eliminate a significant purchaser from the market, and in fact, make the Fed a net seller putting additional downward pressure on bond prices.

We continue to prefer shorter duration, high-quality fixed income exposure to protect from an increase in rates and a widening of credit spreads.

The end of the Fed’s bond buying program could negatively impact spread pricing in the mortgage and asset-backed segment of the bond market as well. We have, as a result, become a bit wary of this segment of the fixed income market. Also, both investment grade and high yield corporate spreads are close to all-time lows and may not provide adequate compensation for the inherent credit risk. These spreads are only a little more than half of their 25-year averages8.

On a positive note, rising yields on shorter maturities should begin to improve yields on money market funds, allowing investors to at least earn something on cash balances. Yields on longer-date maturities should also become a bit more attractive on a nominal basis; however, may still appear rich when adjusted for inflation.

Stocks

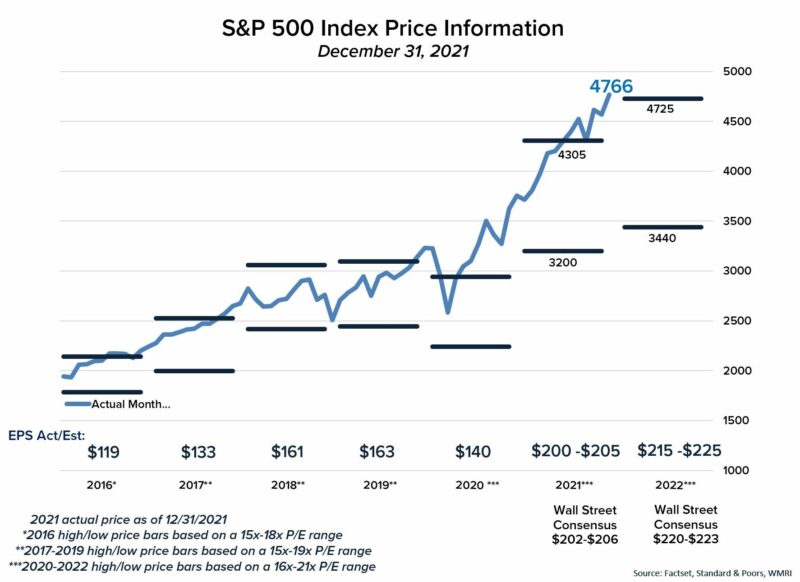

Our stock market outlook is optimistic but guarded. Underlying corporate earnings should be supportive of stock prices, but valuation may be at risk due to rising inflation and interest rates. We expect 2021 S&P 500 earnings per share to be approximately 45% higher than the depressed 2020 level and 24% higher than 2019 pre-COVID-19 levels. We see the potential for additional earnings gains in 2022 driven by still solid underlying economic conditions. Corporate tax rate increases appear to be off the table in recent stimulus/infrastructure spending bill negotiations in Congress, which improved our 2022 corporate earnings outlook9.

Nevertheless, we see some risk to stock market valuation due to the recent increase in inflation levels. Historically, a higher rate of inflation resulted in a lower stock market valuation10. The change in Fed policy also poses risk to valuation – and potentially corporate earnings. A faster than expected increase in the Fed funds rates – and in turn higher market interest rates – could negatively impact valuations, especially for equities with high earnings growth potential.

We are starting to see evidence of rotation out of high growth and speculative stocks into stocks with higher quality fundamentals, which we believe will benefit our equity investment approach on a relative basis. The silver lining to this rotation from highly speculative stocks to fundamentally strong alternatives is a healthy condition that may allow us to avoid a significant market correction, as the correction rolls thru various sectors under the surface without taking down the broad market index.

Our preference is to be long-term equity investors and therefore have a bias towards companies with long-term secular growth potential and/or long-term dividend growth potential. We will continue to emphasize growth at a reasonable price as the style we expect to perform best in 2022.

We continue to underweight our exposure to international equities.

Although valuations appear lower than in the U.S., earnings growth rates across the developed international countries are much less attractive, partly due to their more modest exposure to global- scale information and medical technology companies.

In the emerging markets, heightened risks keep us cautious - specifically the Chinese government’s recent regulatory crackdown on large information technology companies. We believe geopolitical risks relative to China will remain elevated this year and are wary of business models that incorporate a high reliance on continued sales growth in China.

Overall, we have a cautious view on the near-term ability of stocks to continue to produce gains like those recently experienced. We expect some slowdown in earnings growth and see risk to the current valuation level. Nevertheless, the still low-interest rate environment and a lack of attractive investment alternatives may provide near-term support for stock prices.

Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal.

Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. Past performance does not guarantee future results and the opinions presented cannot be viewed as an indicator of future performance. The S&P 500 Index is an unmanaged index and is widely regarded as the standard for measuring large-cap U.S. stock-market performance. In addition, the S&P 500 Index cannot be invested in directly and does not reflect any fees, expenses or sales charges. Further, such index includes 400 industrial firms, 40 financial stocks, 40 utilities and 20 transportation stocks. The information we provide does not constitute investment or tax advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any security. It does not

take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Please consult with your Portfolio Manager, Financial Counselor, Relationship Manager, attorney or tax professional regarding your specific investment, legal or tax situation.1 Factset

2 Factset & US Bureau of Labor Statistics

3 US. Dept of Labor and USA.gov

4 Factset

5 CDC

6 Federal Reserve

7 Factset

8 Factset

9 Factset and Standard & Poors

10 Factset, Standard and Poor’s and U.S. Bureau of Labor Statistics

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.