Fall 2022: Economic & Financial Market Outlook

October 19, 2022

Signs of optimism among investors at the beginning of the quarter faded as persistently high inflation dashed any hope for a quick “pivot” to a less restrictive monetary policy. Financial markets continued to trend lower, faltering under the weight of the Fed’s hawkish moves.

In August, at the Jackson Hole Economic Policy Symposium, Federal Reserve Chairman Jay Powell made it clear that price stability was critical to the economy’s long-term health, and that monetary policy would remain restrictive “until we are confident the job is done.”1 He has been faithful to his word. With a continuing elevated Consumer Price Index (CPI), the Fed has made multiple aggressive 0.75% rate increases, with expectations of another this November.

Following the Jackson Hole pronouncement, U.S. stocks fell 14.6% through the end of 3Q22, adding to a YTD loss of just under 25%.2 The fixed income market did not provide investors with much of a safe haven, either. The Bloomberg U.S. Aggregate Bond Index has dropped 4.7% (including income) since Jackson Hole, ending up 14.6% down year-to-date.3

Futures Markets Suggest Fed to Raise Rates Through Mid-2023

The CPI, the bellwether measure of inflation, is currently running at a scorching 8.2% (through October). This is down from a four-decade high of 9.1% in June, but still well above the Fed’s traditional 2% target3. Just as concerning is October’s rise in the core CPI, which excludes food and energy. This important indicator of stickier-priced items reached 6.6% in the month, a new 40-year high4.

Recognizing the persistence of current inflationary pressures, the Fed funds futures market suggests the Fed will continue to raise rates into 2023, with a likely terminal rate of 4.50%-4.75%.5 To understand how dramatic the Fed’s actions in combating inflation have been this year, you need only recall that the Fed funds rate started the year at just 0.00%-0.25%.

U.S. Economy Remains Resilient Despite the Fed’s Aggressive Policy

At least for now, the economy is showing some resilience in the wake of the Fed’s hawkish posture. Areas such as industrial production, personal consumption expenditures, and retail sales have yet to see much of an impact.

The U.S. labor market also remains strong with:

- 3.8 million jobs created so far in 2022 through September, on top of the 6.7 million jobs created in 20216

- An unemployment rate of 3.5% at a post-pandemic low7

- A striking ratio of 10 million job openings versus roughly 6 million unemployed8.

- Strong wage gains with average hourly earnings for all employees growing at 5% year-over-year.9

Some Early Indicators Suggest Economic Downturn in 2023

A decline in housing demand often portends economic weakness. A 30-year fixed rate mortgage is now slightly above 7.00%, versus 3.27% on December 31, 2021.10 As a result, mortgage applications for home purchases have plummeted 39% year-to-date; and are off 51% from peak levels set over the past two years.11 Existing home sales have also fallen 21% year-to-date and are off 29% from their recent peak in 2020.12

We expect consumer expenditures to weaken in the coming months as well. The Conference Board’s U.S. Consumer Confidence Index has improved recently, likely due to a weakening in energy prices. But the expectations component of the index, based on consumers’ forward six-month view of income, business, and labor market conditions, has declined sharply this year, suggesting slower economic growth in the months to come.13

Recession on the Horizon

Consensus estimates for U.S. GDP growth are falling, suggesting a heightened risk of recession in early to mid-2023. The consensus estimate for U.S. GDP growth in 2022 is now 1.7%, down from 2.5% in June, while the estimate for 2023 is now 0.8%, down from 1.8% in June.14 U.S. GDP estimates for the first and second quarter of next year are actually negative at -0.3% and -0.1%, respectively.15

Even if we fall into recession, there are still reasons to hope for a mild one. Pent up consumer demand for goods and services following the pandemic remains strong, and the U.S. labor market continues to show solid employment growth and income gains. Corporate balance sheets are also healthy, and the banking system is well capitalized.

It’s also important to note that next year’s expected economic growth slowdown is more about supply scarcity, inflation, and Fed policy than a lack of demand. This portends a more benign outcome compared to the complete shutdown of the global economy in 2020 or the potential collapse of the banking system in the 2008-2009 recession.

The State of The Financial Markets: Still Cautious

Fixed income

We expect interest rates will remain volatile, with the potential to move higher as the Fed further tightens monetary policy.

Short-term Yields

Yields on two-year U.S. Treasury bonds hit a fifteen-year high of 4.31% in late September, up from 0.73% at the beginning of the year, before falling back to 4.20% at quarter’s end.16 The sharp increase in two-year yields reflects expectations of additional aggressive Fed funds rate hikes through the remainder of the year. Ultimately, we would expect two-year yields to move towards the expected cycle peak in the Fed funds rate, which the Fed funds futures market suggests could be 4.50%-4.75%.17

Upcoming reports on inflation will have a significant impact on Fed funds rate expectations, and in turn, two-year yields. Higher than expected inflation reports would indicate the Fed will need to stay aggressive and may move Fed funds expectations and yields higher, while reports of weakening prices may keep the Fed at bay.

In any event, yield volatility will likely stay elevated until we get some clear indication that inflation is under control.

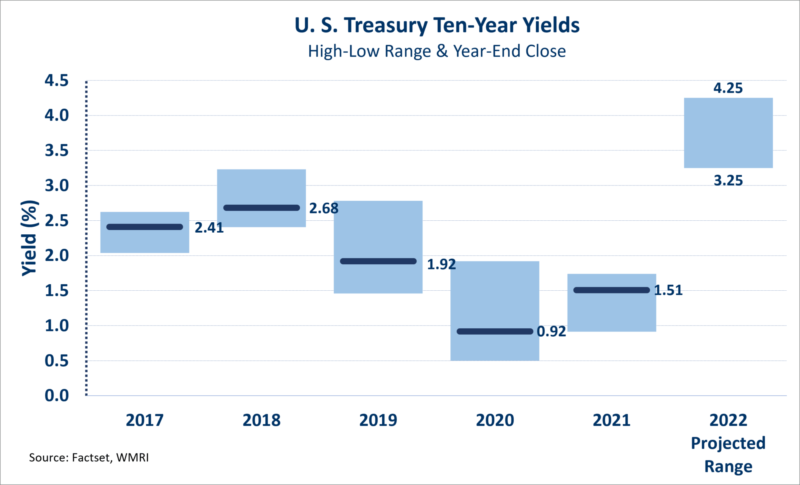

Long-Term Yields

Yields on ten-year U.S. Treasury bonds hit a twelve-year high of 3.96% in late September, up from 1.51% at the beginning of the year, before ending the quarter at 3.80%.While long-term yields are at twelve-year highs18 and are much more attractive than even six months ago; it’s still too early to dismiss further increases. We expect longer-term yields to continue to increase in 2022, driven partly by additional quantitative tightening by the Fed. The Fed's transition from a purchaser to a seller of fixed-income securities can be expected to create upward pressure on market yields..

The CPI (core), an inflation measure which excludes food and energy prices, is currently at 6.6%, making 10-year ‘real’ yields significantly negative19. At some point, we expect inflation to subside and 10-year yields to provide a positive ‘real’ yield. However, the inflation rate will likely 'normalize' at a level above that experienced in the decade prior to the pandemic, when the average annual CPI was just 1.7%.20

Credit spreads may still not fully reflect an economic slowdown. Both Investment Grade and High Yield Corporate spreads, 1.59% and 5.52%, respectively, have widened significantly this year and are close to their twenty-year averages.21 Even so, credit spreads typically spike well above their long-term averages during economic slowdowns, reflecting heightened credit risks. In addition, the end of the Fed’s bond-buying program could negatively impact spread pricing in the mortgage and asset-backed segment of the bond market.

We maintain our bias towards high-quality fixed-income exposure to protect from widening credit spreads resulting from weakening economic conditions. With yields now at decade-plus highs, inflation expectations moderating, and recession risk increasing, specific fixed-income market segments are becoming more attractive. We continue to prefer shorter-duration securities but adding some longer-dated maturities may soon make sense.

Stabilization in inflation would lead us to be more constructive on fixed-income investments. This could be coming soon.

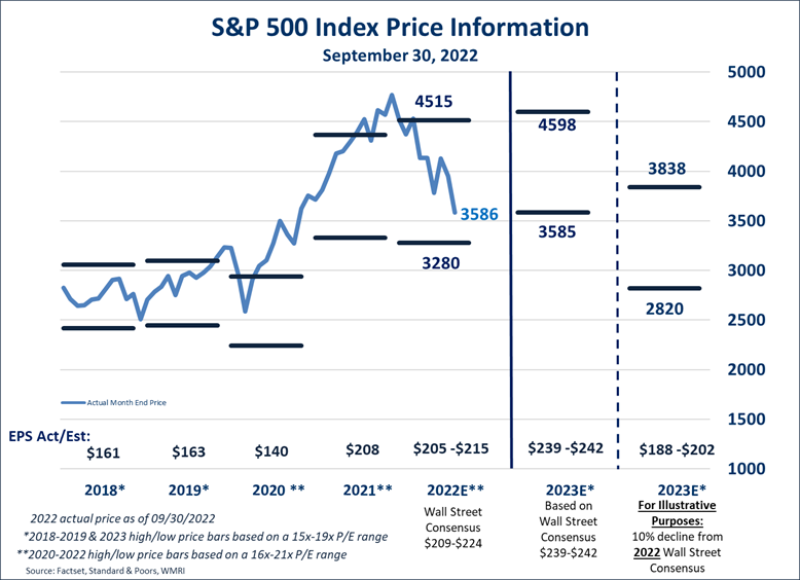

Equities

Despite the S&P 500’s near 25% decline year-to-date22, we believe additional downside is possible.

Current consensus estimates call for 8% earnings growth in 2022 and 202323. However, if the economy falls into recession, we expect earnings to contract. A double-digit percentage decline in earnings would surely be possible, even in relatively mild recessionary conditions.

We also see risk to stock market valuation due to high inflation levels and interest rates. Historically, a higher rate of inflation results in a lower stock market price-to-earnings ratio, and even though the price-to-earnings ratio is now at a more reasonable 17.1x versus the 21.7x at the start of the year, we believe additional valuation compression is possible. A slowing economy and reductions to S&P earnings estimates may also negatively impact investor sentiment and put further downward pressure on valuation.

We expect investors in the near- to intermediate-term to continue to favor value stocks. High inflation and interest rates reduce the present value of future earnings and, therefore disproportionately impact the value of growth stocks.

Our preference is to be long-term equity investors with a natural bias towards high-quality companies with long-term secular and/or long-term dividend growth potential. This ‘growth’ component of our equity strategy preference may be challenged in the short-term, but we believe it offers greater rewards over time.

We continue to underweight our exposure to international equities.

In developed countries, although valuations appear lower than in the U.S., earnings growth rates are much less attractive, partly due to more modest exposure to global-scale information and medical technology companies. The Russian/Ukraine conflict has also had a much more significant and direct impact on European economies, elevating the risk of recession across the continent.

Heightened risks, particularly the Chinese government’s recent regulatory crackdown on large information technology companies, also add to our reserved posture toward emerging markets.

Overall, we maintain our cautious view on near-term stock market performance. We expect a slowdown in earnings growth and see risk to the current valuation level. Volatility also may stay elevated due to the expected, but still uncertain, actions from the Fed. Also of concern are exogenous events that can impact our investment outlook, including:

- The war in Ukraine

- The outbreak of a new, more virulent COVID strain

- The upcoming mid-term elections and potential leadership changes in Washington

1 Source: Prepared remarks by Federal Reserve Chairman, Jerome Powell, at the Jackson Hole Economic Policy Symposium 2022, August 26,2022.

2 Factset

3 Factset

4 Factset

5 CME FedWatch, October 12,2022

6 Factset

7 Factset

8 Factset

9The Employment Situation September 2022, BLS, October 7, 2022

10 Bankrate

11 Mortgage Bankers Association October 7, 2022

12 Factset

11 The Conference Board, September U.S. Consumer Confidence press release, Sept. 27, 2022

12 Factset

13 Factset

14 Factset

15 Factset

16 Factset

17 CME Group, CME FedWatch Tool, Oct. 12, 2022

18Factset

19Factset

20Factset

21Factset

22Factset

23Factset

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.