A Time for New Beginnings

January 19, 2022

We Can Help You with Your Resolutions!

At Washington Trust Wealth Management, our goal is to help you achieve your goals—and this includes your New Year’s resolutions!

When you want to make changes

Although we may not be qualified to help you take up a new hobby or improve your fitness, we can help you create a wealth plan that allows you to take care of yourself and your family. Whether you foresee buying a vacation home to spend more time with your family, finally launching that new business you’ve had in mind, or achieving your philanthropic goals, your Washington Trust Wealth Advisor will help you plan to make it happen!

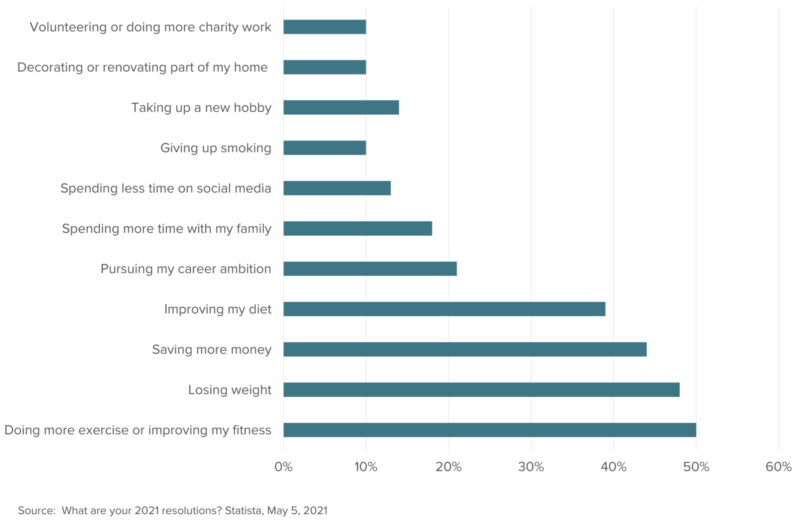

Top New Year's Resolutions

Life events may have occurred

We all experience life transitions at some point in time. The new year is a reminder to review and adjust your wealth plan to accommodate changes you’ve experienced since your last plan. For example:

- If you’ve welcomed a new child or grandchild, you may want to evaluate your options for contributing towards his or her education, such as through an UGMA or UTMA custodial account, 529 plan, or trust, and update your estate plan.

If you’ve switched jobs, it may be time for a review of your executive compensation to make sure your portfolio remains diversified. And if you’ve received a sign-on or other bonus, we can help you determine how to invest those funds. If you are considering a move, we can help you evaluate the tax and other implications of your current and potential future compensation. And, we can help you determine how you should handle your prior company’s retirement plan balance and talk about your options. Each option has its own advantages and drawbacks, so we are here to help you decide what is best for your personal situation.

- If your marital status is no longer the same, your plan needs to be updated to meet your new financial situation, needs, and goals. For example, your tax situation, estate planning goals, and insurance requirements may have shifted, and there will be important details to take care of, such as updating the designations on your investment accounts and life insurance policies.

- If you’re contemplating an early retirement, you want to make sure you’ll have the resources to enjoy it! More than three million Americans, many of them young Baby Boomers, retired earlier than planned due to COVID-19 health concerns and increased asset values.* If you’ve been dreaming about leaving the work force, your Washington Trust Wealth Advisor can help you evaluate your options and create a plan that includes a tax- efficient withdrawal strategy and optimizing your Social Security benefits.

The new year ushers in new beginnings, and you want to be prepared. It’s a good idea to review your investment portfolio and objectives regularly, even if you have not experienced a major life transition, to make sure you remain on track and capture opportunities.

Contact your Washington Trust Wealth Advisor to see how we can help you achieve your resolutions and stay on your path through life’s transitions!

Source: Covid Early Retirees Top 3 Million in U.S., Fed Research Shows, Bloomberg, October 22, 2021

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.